Investing: How to Build Wealth in Global Markets with Smart Strategies

When you think about investing, the act of putting money to work to grow your wealth over time. Also known as building long-term assets, it’s not about getting rich quick—it’s about staying consistent, avoiding costly mistakes, and using tools that actually work. Whether you’re starting with $10 or $10,000, the goal is the same: make your money work harder than you do.

Dividend investing, a strategy focused on earning regular cash payments from stocks. Also known as income investing, it’s one of the most reliable ways to build wealth without constantly watching the market. Companies like those in the S&P 500 pay dividends because they’re profitable and stable—something you can count on even when the market dips. Then there’s index funds, a single fund that owns hundreds or thousands of stocks to give you instant diversification. Also known as passive investing, they’re the simplest way to own the whole market without picking individual stocks. And when you’re ready to buy, you’ll need a reliable brokerage platform, an online service that lets you buy and sell stocks, ETFs, and bonds. Also known as online broker, it’s your gateway to global markets—but not all are created equal. Some charge hidden fees. Others crash when you need them most. And a few even make it easy to accidentally buy risky penny stocks.

Investing isn’t just about picking the right stocks or funds. It’s about knowing when to hold, when to rebalance, and how to protect yourself when things go wrong. Event-driven rebalancing helps you adjust your portfolio when the Fed changes rates or a company reports surprise earnings. Micro-investing apps let you start with spare change. Lump sum investing might beat dollar-cost averaging over time—but only if you can stomach the drops. Special dividends can be a gift or a warning sign. Blue-chip stocks offer stability. Small caps offer growth. And when your trading app goes down during a market crash, having a backup plan isn’t optional—it’s essential.

You don’t need to be a Wall Street expert to win. You just need to know what matters, avoid the traps, and stick with a plan. Below, you’ll find real, tested advice from investors who’ve been there—no fluff, no hype, just what works in today’s markets.

Minimum Diversification: How Many Stocks Do You Really Need?

How many stocks do you really need to be properly diversified? Research shows 15 isn't enough - 30 to 50 is the real sweet spot for reducing risk without burning out. Here's what the data says today.

Index Funds vs Active Funds: Which Is More Tax Efficient?

Index funds are significantly more tax-efficient than active funds due to lower trading activity, fewer capital gains distributions, and lower fees. Learn why they save investors thousands in taxes annually.

Corporate Bond Research: Understanding Spread, Leverage, and Coverage Ratios

Learn how credit spread, leverage ratios, and coverage ratios reveal the true risk of corporate bonds. Understand what these metrics really mean-and how to use them to avoid costly mistakes in fixed income investing.

Global Macro Strategy: How to Invest Using Economic Themes

Global macro strategy lets investors profit from economic trends like inflation, interest rates, and currency shifts - not individual stocks. Learn how top investors use macro themes to navigate crises and diversify portfolios.

Broker Outages: What to Do When Platforms Go Down

When your trading platform crashes during a market drop, you can’t act-and that costs money. Learn how to prepare for broker outages with backup accounts, SMS alerts, and emergency plans to protect your investments.

Micro-Investing Apps: How to Start Building Wealth with Just a Few Dollars

Micro-investing apps let you start investing with just a few dollars. Learn how round-ups, fractional shares, and automation help you build wealth over time-even with a tight budget.

Special Dividends: What One-Time Payments Mean for Your Portfolio

Special dividends are one-time cash payments from companies to shareholders, often triggered by asset sales or record profits. Learn what they mean for your portfolio, how they're taxed, and whether they signal strength or weakness.

Lump Sum Investing vs Dollar-Cost Averaging: Which Strategy Delivers Better Returns?

Lump sum investing typically delivers higher returns than dollar-cost averaging, but DCA helps investors stay calm during market drops. Learn which strategy works best based on your risk tolerance and goals.

Event-Driven Rebalancing: How Rate Hikes, Earnings, and Policy Change Your Portfolio

Event-driven rebalancing uses real market events-like Fed rate hikes, earnings surprises, and policy shifts-to adjust your portfolio. It outperforms traditional methods during volatile periods and reduces volatility, but requires discipline to avoid false triggers and unnecessary trading costs.

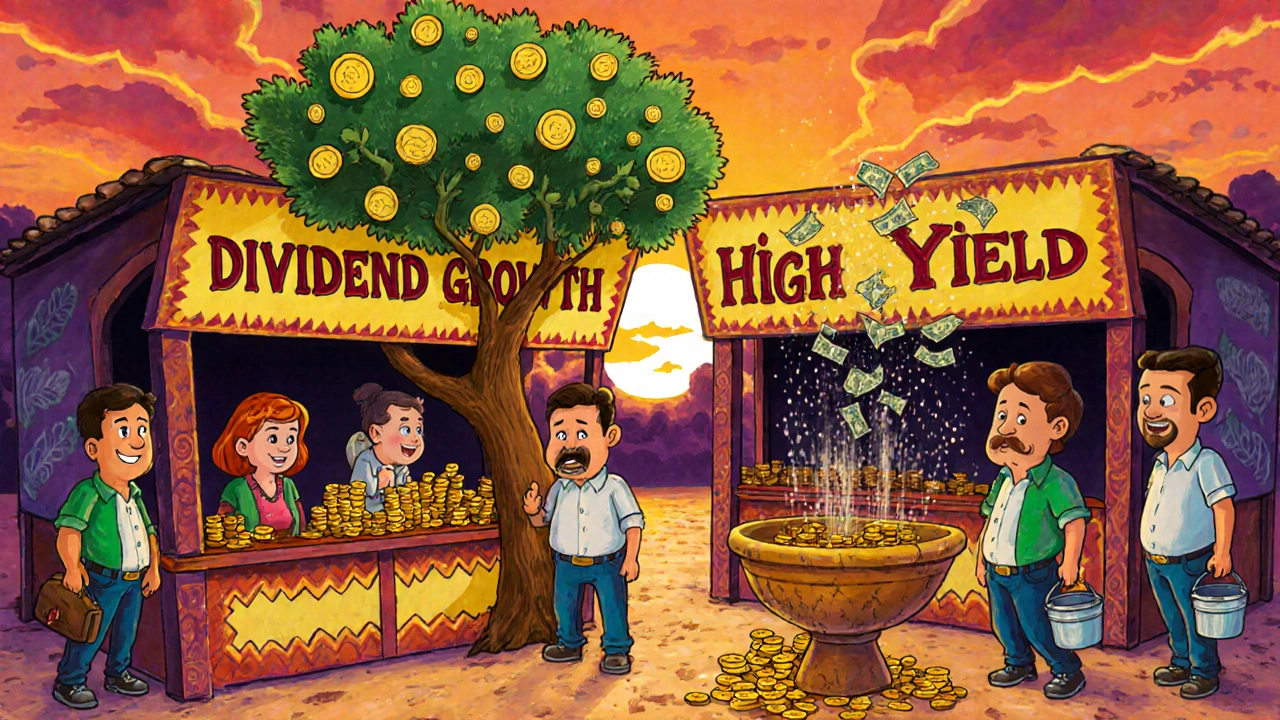

Dividend Growth vs Current Yield: Which Strategy Wins for Long-Term Wealth?

Dividend growth and current yield are two very different paths to income investing. One builds wealth over time. The other gives you cash now - but at a risk. Learn which one suits your goals and why growth often wins long-term.

Penny Stock Trading: Hidden Costs and Common Scams to Avoid

Penny stock trading looks tempting, but hidden fees, poor liquidity, and rampant scams make it one of the riskiest ways to invest. Learn the real costs and how to avoid the most common traps.

Total Market Index Funds: The Simplest Diversified Portfolio

A total market index fund gives you instant ownership of nearly every U.S. stock with low fees and no guesswork. It's the simplest, most proven way to build long-term wealth without picking stocks or timing the market.