Penny Stock Trading Cost Calculator

Calculate Your Real Trading Costs

Most traders only see the commission fee, but penny stocks have hidden costs that can wipe out your profits. Enter your trade details below to see what you're really paying.

Your Trade Breakdown

Note: The bid-ask spread is typically 15-20% for penny stocks. This calculator uses 18% as a conservative estimate, but actual spreads can be much higher.

⚠️ Warning: 89% of penny stocks fail within five years. These fees alone can wipe out your potential profits before you even see a gain.

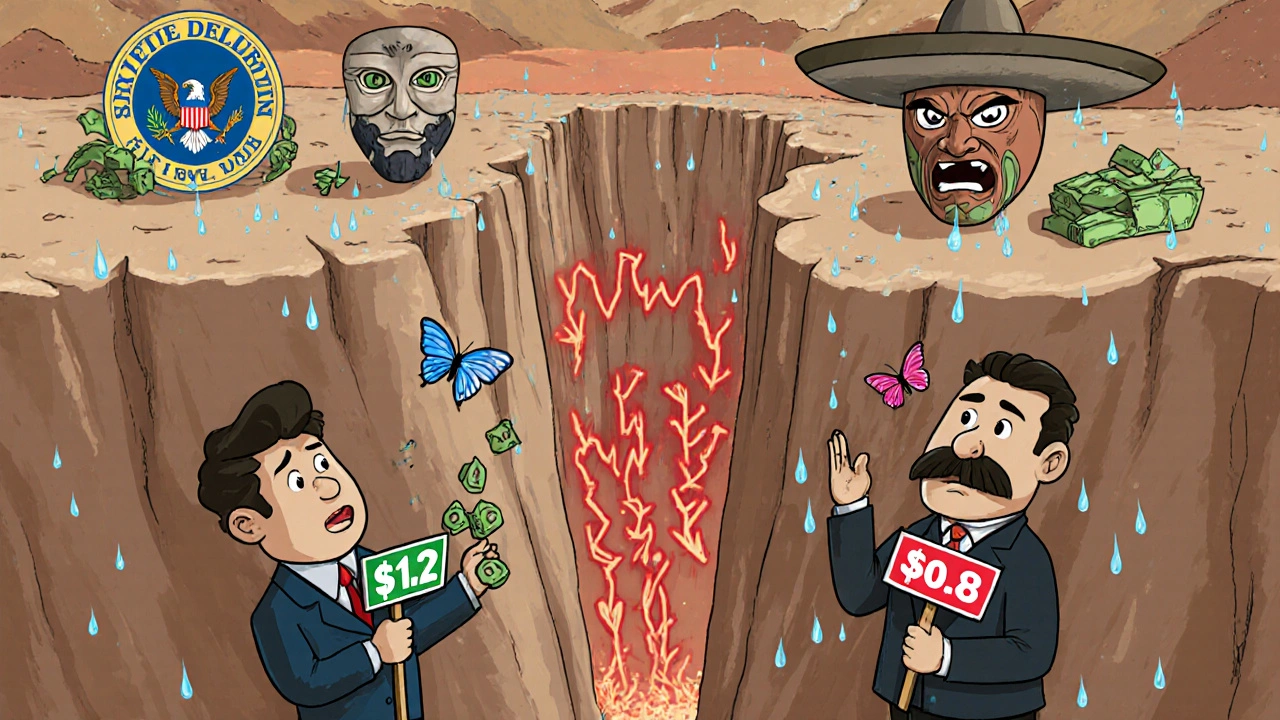

Most people hear "penny stock" and think of a quick path to riches. Buy a stock at $0.05, watch it jump to $0.50, and suddenly you’ve made ten times your money. It sounds like a lottery ticket with a ticker symbol. But behind the hype lies a minefield of hidden fees, slippage, and outright fraud. If you’re thinking about jumping into penny stocks, you need to know what most brokers won’t tell you.

What Exactly Is a Penny Stock?

A penny stock is any share trading below $5 per share, according to the U.S. Securities and Exchange Commission. But in practice, traders treat anything under $1 as the real target. These stocks aren’t listed on major exchanges like the NYSE or Nasdaq. Instead, they trade on OTC markets - mostly the OTC Pink Sheets, where companies don’t have to file financial reports with the SEC. That means no quarterly earnings, no audited balance sheets, and often no real business at all. About 10,000 to 15,000 penny stocks trade daily. Most have market caps under $50 million. That’s tiny. A single large institutional trade can move the price 20% in minutes. And because there’s so little trading volume - 68% of these stocks trade fewer than 5,000 shares a day - you’re often stuck holding a stock you can’t sell.The Hidden Costs No One Talks About

You think you’re paying $5 per trade? Think again. The real cost of trading penny stocks isn’t the commission. It’s the hidden fees buried in the trade execution. First, there’s the bid-ask spread. On a stock like Apple, the spread might be a fraction of a cent. On a penny stock? It’s often 15% to 20% of the stock price. So if you buy a stock at $0.10, the seller might only be willing to pay $0.08 when you try to sell. That’s a 20% loss before the market even moves. Then there’s the SEC fee: $0.00011 per share. FINRA adds another $0.000022 per share. For a 10,000-share trade, that’s over $1.30 in fees - not counting your broker’s commission. Some brokers charge extra for OTC trades, sometimes $0.0065 per share, compared to $0.0035 for NYSE stocks. And settlement? It’s not always T+2. About 22% of OTC trades take more than five days to settle. That means your money is tied up longer, and you can’t use it to buy another stock. If you’re day trading, this delay can kill your strategy.Pump-and-Dump Schemes: The #1 Scam

The most common scam? Pump-and-dump. It’s simple: someone buys a cheap stock, then floods social media with fake news, Telegram alerts, and YouTube videos claiming it’s the next big thing. They use AI-generated press releases, deepfake videos of supposed CEOs, and fake analyst reports. You see a post: "XYZ Biotech just cured cancer! Stock at $0.03 - buy before it hits $5!" You jump in. Within hours, the price spikes to $0.15. You feel smart. Then, within 48 hours, it crashes to $0.02. The person who "promoted" it sold their 10 million shares at the peak. You’re left holding the bag. The SEC says penny stocks account for 37% of all securities fraud cases - even though they make up less than 1% of all listed stocks. FINRA reported a 22% jump in pump-and-dump schemes in 2024, mostly driven by Discord and Telegram groups targeting young investors.

Why You Can’t Sell When You Want To

Liquidity is the silent killer. If you own 50,000 shares of a stock that trades 3,000 shares a day, you’re not going to sell it all at once. You’ll have to sell in chunks over days or weeks. And each time you sell, the price drops because you’re flooding the market. Bloomberg’s 2024 analysis found that selling a $10,000 position in a typical penny stock takes 37 minutes on average and causes an 8.2% price drop just from your own trades. That’s called slippage. You think you’re selling at $0.12. You end up getting fills between $0.08 and $0.11. That’s a 25% loss before the stock even moves down. Reddit users on r/StockMarket report that 78% have had at least one trade fail because there were no buyers at their price. One trader wrote: "Tried to sell 50k shares of XYZ at $0.12. Got filled at $0.08-$0.11. Lost $2,000 just from not being able to sell cleanly."How to Spot a Real Company (Rare as It Is)

Most penny stocks are shell companies with no revenue. But a few are legitimate. Here’s how to tell the difference: - Check if the company is on OTCQX or OTCQB, not Pink Sheets. These tiers require financial disclosures. - Look for audited financials on EDGAR (SEC’s database), not just a press release on their website. - Verify management with LinkedIn. Are they real people with track records? - Check if they have a physical address, not just a P.O. box. - Avoid companies with names like "Global Innovations Corp" or "Quantum Energy Solutions" - they’re usually empty shells. Successful traders spend 8.2 hours a week researching each position. They don’t chase hype. They look for companies with real revenue, a clear product, and independent verification of assets.

Brokerage Barriers and Account Requirements

Not every broker lets you trade penny stocks. Charles Schwab requires Level 4 approval: $25,000 minimum balance and 24 months of trading experience. TD Ameritrade requires Level 3: $10,000 minimum. If your account doesn’t meet these, you’re locked out - and for good reason. Some brokers also charge monthly inactivity fees for OTC positions. If you buy a stock and forget about it, you could pay $50 a month just to hold it. Read your broker’s fee schedule carefully. Many don’t list OTC fees upfront.What Works: Real Strategies from Successful Traders

A few people make money in penny stocks. They don’t gamble. They treat it like a high-risk hedge. Top traders on TradingView follow three rules:- Never risk more than 1% of your total portfolio on a single penny stock.

- Set stop-losses at 15-20% below your entry. If the stock drops, get out fast.

- Only trade stocks with at least 10,000 shares daily volume. Low volume = no exit.

Bottom Line: Is It Worth It?

The odds are brutal. FINRA says 89% of penny stocks fail within five years. Compare that to 28% for IPOs on major exchanges. The SEC’s data shows you’re 78% more likely to encounter false financial statements in a penny stock than in a regular company. If you still want to try, treat it like a lottery ticket - not an investment. Put no more than 5% of your portfolio into penny stocks. Use only money you can afford to lose. And never, ever follow a Telegram alert or a YouTube influencer. Penny stocks aren’t a shortcut to wealth. They’re a trap for the impatient. The real money isn’t in guessing which $0.07 stock will go to $0.70. It’s in avoiding the ones that go to $0.00.Are penny stocks legal?

Yes, penny stocks are legal. But the companies behind them often aren’t. Many trade on unregulated OTC markets with no financial reporting requirements. The problem isn’t the stock - it’s the fraud, manipulation, and lack of transparency that surround them. The SEC regulates trading activity, but not the quality of the companies themselves.

Can you make money trading penny stocks?

You can, but it’s extremely rare. Most people lose money. The few who succeed treat it like a high-risk speculative play, not a long-term investment. They use strict risk controls: small position sizes, stop-losses, and only trade stocks with real financials and decent volume. For 99% of retail investors, the risks far outweigh the potential rewards.

How do I avoid penny stock scams?

Avoid social media hype. Never buy a stock because someone on TikTok, Telegram, or YouTube says it’s a "10x opportunity." Research the company on EDGAR. Check its trading volume. Look for audited financials. If the company has no website, no management team, or no revenue, walk away. If the stock is under $0.10 and suddenly spikes 50% in a day, it’s almost certainly a pump-and-dump.

What’s the difference between OTCQX, OTCQB, and Pink Sheets?

OTCQX is the highest tier - companies must meet financial standards and disclose regular reports. OTCQB is for early-stage companies with basic reporting. Pink Sheets is the lowest tier - no financial reporting required. Most scams are on Pink Sheets. Stick to OTCQX or OTCQB if you must trade penny stocks.

Why do brokers restrict penny stock trading?

Because of the high risk of fraud, low liquidity, and frequent customer complaints. Brokers are required to ensure clients understand the risks. That’s why they require minimum account balances and trading experience before allowing access. If you don’t meet those requirements, it’s not a barrier - it’s protection.

Should I invest in penny stocks if I’m a beginner?

No. Beginners should focus on learning the basics of investing through low-cost index funds or ETFs. Penny stocks require deep research, emotional discipline, and an understanding of market microstructure. Without those, you’re just gambling. Save penny stocks for later - if at all.

Astha Mishra

November 15, 2025 AT 06:24It's fascinating how the allure of quick wealth blinds so many to the structural decay beneath these so-called opportunities. Penny stocks aren't just risky-they're systematically designed to exploit the hope of the uninformed. I often wonder if the real scam isn't the pump-and-dump, but the entire cultural narrative that equates financial literacy with gambling intuition. Why do we glorify the 'overnight millionaire' when history shows that patience, not panic, builds real capital? The market doesn't reward haste; it rewards those who study the architecture of value, not the noise of hype. And yet, we keep feeding the machine, hoping this time, the lottery ticket will be the one that pays out. Maybe the true investment is in unlearning the myths we've been sold since childhood.

Kenny McMiller

November 16, 2025 AT 21:02Bro, the bid-ask spread on these OTC garbage is insane-like 20% slippage before you even blink. And don’t get me started on the SEC/FINRA fees stacking up like a pyramid scheme. You think you’re paying $5 per trade? Nah, you’re paying $12 in hidden friction. And settlement delays? That’s not a bug, it’s a feature for brokers who want your capital locked up while they rake in margin interest. Bottom line: if your broker doesn’t explicitly list OTC fees in plain text, they’re gaslighting you. Always check the fine print-or better yet, just avoid the whole cesspool.

Dave McPherson

November 18, 2025 AT 11:01Oh sweet mercy, another ‘educational’ post from someone who thinks ‘research’ means reading a press release written by a bot trained on 2010s crypto forums. You call this ‘deep analysis’? It’s just a bullet-pointed obituary for delusional retail traders. The real tragedy isn’t the scams-it’s that people still believe there’s a ‘strategy’ to this dumpster fire. You don’t ‘trade’ penny stocks-you participate in a financial performance art piece where the audience is the mark and the stage is a Discord server with 200k members who all think they’re Warren Buffett after buying $50 of ‘Quantum Energy Solutions.’ Wake up. The only thing you’re investing in is your own ego, and even that’s depreciating faster than the stock you’re holding.

RAHUL KUSHWAHA

November 19, 2025 AT 18:19