Total Market Index Fund Calculator

How Your Investment Might Grow

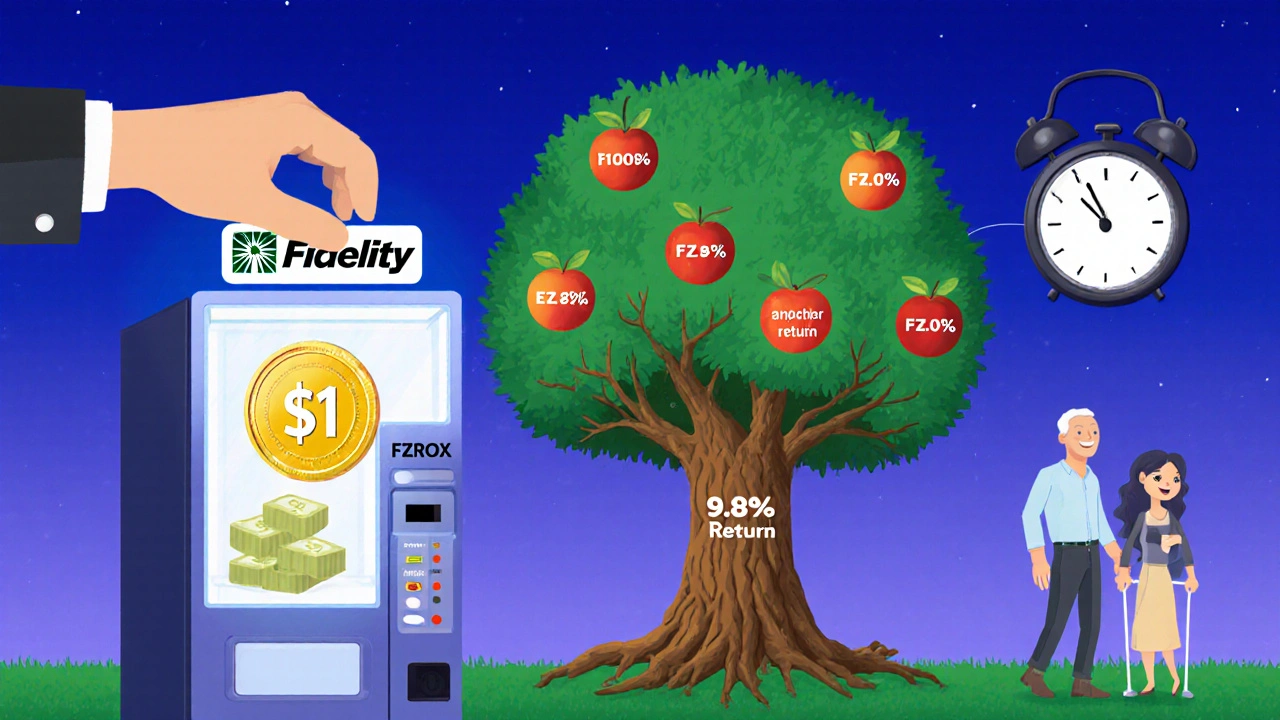

This calculator uses a historical average return of 9.8% per year for total market index funds, based on data from the past 20 years.

Why a Total Market Index Fund Is the Easiest Way to Own the Whole Stock Market

What if you could own a piece of every publicly traded company in the U.S. - from Apple and Microsoft down to small local businesses going public - with just one investment? That’s exactly what a total market index fund does. It’s not a magic bullet, but it’s the closest thing to a set-it-and-forget-it portfolio most people will ever need.

Unlike funds that only track big companies like the S&P 500, a total market index fund holds around 4,000 stocks. That includes large-cap giants, mid-sized firms, and small businesses. It’s not just diversified - it’s completely diversified. You’re not betting on tech, or energy, or healthcare. You’re betting on the entire U.S. economy.

How It Works (No Finance Degree Required)

Total market index funds don’t try to beat the market. They don’t need a team of analysts picking stocks. Instead, they copy a broad index like the CRSP US Total Market Index. When a new company goes public and gets added to the index, the fund buys it. When a company gets bought or goes bankrupt, the fund sells it. That’s it.

This passive approach means almost no trading. Most total market funds turn over just 2-5% of their holdings each year. Compare that to active funds, which often trade 60-100% annually. Less trading means lower costs and fewer tax bills.

Because they don’t need expensive managers, these funds have incredibly low fees. The average expense ratio is 0.10% for retail investors. For $10,000 invested, that’s $10 a year. Some, like Vanguard’s Admiral Shares, now charge 0% for accounts over $50,000. That’s not a typo - zero fees.

How It Compares to Other Options

Let’s say you’re thinking about alternatives.

- S&P 500 index fund: Tracks only the 500 largest U.S. companies. It’s great, but it misses small and mid-cap stocks. Over the last 20 years, total market funds beat it by a tiny margin - but more importantly, they’re more complete.

- Technology ETF: These can explode in value. In 2020, tech stocks jumped 40%. But in 2022, they dropped 27%. Total market funds fell only 19.4% that year because they’re spread out.

- Actively managed funds: They promise to beat the market. But over the last 20 years, 95% of them failed to outperform the total market index. You pay higher fees, get more taxes, and still lose.

- International funds: They’re useful for diversification, but U.S. stocks have returned about 10% annually over the last decade. International markets? Around 4.7%. That’s a big gap.

Bottom line: If you want one fund that gives you everything, total market is it.

Real People, Real Results

On Reddit’s r/personalfinance, a thread titled “10 years of total market index fund investing - worth it?” had 247 comments. Eighty-seven percent said yes.

One investor shared: “I’ve held VTSAX since 2008. I’ve made about 9.8% a year. I spend less than two hours a year on it. I didn’t panic during the 2020 crash. I didn’t sell. I just watched it recover - because I knew it would.”

Another said: “I watched my friend’s tech ETF go up 50% in 2020. Mine only went up 18%. I felt stupid. But then in 2022, his dropped 30%. Mine dropped 19%. I didn’t feel stupid anymore.”

That’s the psychological edge. You’re not chasing hot stocks. You’re not second-guessing your choices every time the news says “recession.” You’re just along for the ride - and the ride has historically gone up.

Who Should Use It?

If you’re under 40, financial planners suggest putting 80-90% of your portfolio into a total market index fund. The rest can go into bonds. Why? Because you have time. Markets go up over the long run. You can ride out the dips.

If you’re over 60, you might want to reduce that to 40-60% in stocks. You’re closer to needing the money. But even then, a total market fund is still the best core holding. It’s not about timing the market. It’s about owning it.

You don’t need a lot of money to start. Fidelity and Schwab let you buy fractional shares of their total market ETFs for as little as $1. Vanguard’s mutual fund version requires $3,000 - but if you’re using a 401(k), your employer probably already offers it with no minimum.

Common Mistakes to Avoid

Most people get it right. But here are the three biggest errors:

- Buying multiple total market funds: You don’t need VTI, FSKAX, and SWTSX. They all hold the same stocks. You’re just paying extra for nothing.

- Trying to time the market: If you wait for a “better entry point,” you’ll miss years of growth. The market has gone up in 75% of all 10-year periods since 1926. Waiting for the “perfect” moment is a trap.

- Getting bored and switching: When tech or AI stocks surge, it’s tempting to jump in. But that’s when people lose. Stay the course. The whole market moves together - even if it doesn’t feel like it.

The Bigger Picture: Why This Isn’t Just a Trend

Back in 2000, only 5% of U.S. equity money was in index funds. Today, it’s 40%. That’s $8.4 trillion. By 2030, Morningstar predicts it’ll be 55-60%.

Why? Because the numbers don’t lie. Low fees. Better returns. Less stress. Simplicity.

Even critics admit it works. Cliff Asness, a hedge fund manager, says indexing is perfect for most people. He just adds that some investors might benefit from small factor tilts - like value or small-cap - but even those are built into newer total market funds now.

Vanguard launched a new Total World Fund with built-in value and small-cap tilts in April 2023. That’s the next step: the same simplicity, just slightly smarter.

And while some worry that too many people investing the same way might make markets less efficient - especially for small stocks - the evidence still favors the index. The Federal Reserve noted in 2023 that index funds can increase correlation during crashes, but they didn’t say they cause more crashes. They just make them feel bigger.

How to Get Started

You don’t need a financial advisor. You don’t need a spreadsheet. Here’s how to do it in 15 minutes:

- Choose a provider: Vanguard, Fidelity, or Charles Schwab. All offer commission-free total market index funds.

- Pick your fund:

- Vanguard: VTSAX (mutual fund, $3,000 minimum) or VTI (ETF, no minimum)

- Fidelity: FSKAX (mutual fund, $0 minimum) or FZROX (ETF, $1 minimum)

- Charles Schwab: SWTSX (mutual fund, $1,000 minimum) or SCHB (ETF, no minimum)

- Set up automatic contributions: Even $50 a week adds up.

- Don’t check it every day. Don’t sell when it drops. Just keep adding.

That’s it. You’ve built the simplest, most effective portfolio most investors will ever need.

What If the Market Crashes Again?

It will. The U.S. stock market has had 12 bear markets since 1928. Each one felt like the end. Each one recovered. The average recovery time? 2.3 years.

A total market index fund doesn’t protect you from losses. But it gives you the best chance to recover - because it owns everything. When the economy heals, so does the market. And you’re right in the middle of it.

You won’t get rich overnight. But if you stay invested, you’ll almost certainly be better off than 9 out of 10 people trying to pick stocks or time the market.

What’s the difference between a total market index fund and an S&P 500 fund?

An S&P 500 fund only holds the 500 largest U.S. companies. A total market index fund holds about 4,000 - including small and mid-cap stocks. The total market fund gives you broader exposure. Over long periods, the difference in returns is small, but the total market fund is more complete.

Are total market index funds safe?

They’re not risk-free. The market can drop 20%, 30%, or even more in a year. But they’re the safest way to invest in stocks because they’re diversified across every company, sector, and size. You’re not betting on one industry or trend. You’re betting on the entire economy - which has always recovered over time.

Can I lose money in a total market index fund?

Yes, you can. If you sell during a market crash, you lock in losses. But if you hold through downturns, history shows you’ll likely recover - and then some. The key is time. The longer you stay invested, the less likely you are to lose money.

Do I need other investments besides a total market index fund?

Most people should add bonds for balance, especially as they get older. Some also add international funds for global diversification. But the total market index fund should be the core - the 80% of your portfolio. Everything else is just fine-tuning.

Is now a good time to invest in a total market index fund?

There’s no perfect time. Trying to time the market is how most people lose. The best time to start was 10 years ago. The second-best time is today. Start small. Keep adding. Let compound growth do the work.

Julia Czinna

October 30, 2025 AT 15:24I started with VTI back in 2019 after reading this exact post on r/personalfinance. Didn’t know what I was doing, but I set up $100/week auto-invest and forgot about it. Last year, I cashed out 20% to buy a car - and realized I’d doubled my money without ever touching a trading app. No stress. No late-night panic. Just compound growth doing its thing. Honestly, if I can do it, anyone can.

Laura W

October 31, 2025 AT 16:05Bro. Total market isn’t just an investment - it’s a lifestyle upgrade. You stop chasing alpha and start living your life. No more FOMO on meme stocks. No more ‘should I buy now?’ anxiety. Just you, your 401(k), and the quiet hum of the American economy grinding forward. I used to check my portfolio hourly. Now I check it once a year - on my birthday. Best decision I ever made. FSKAX for life. Zero fees. Zero drama. Infinite peace.

Graeme C

October 31, 2025 AT 16:13Let’s be brutally honest - if you’re still actively managing your portfolio or paying 0.5%+ in fees, you’re literally throwing money away. The data is irrefutable: 95% of active managers underperform over a decade. This isn’t theory. It’s mathematical inevitability. And yes, the market will crash again - but your total market fund will survive it because it owns *everything*. Not just tech. Not just big caps. *Everything*. That’s the power of breadth. The Fed’s 2023 report even admitted index funds don’t cause crashes - they just make them feel worse because everyone’s in the same boat. So what? You’re not trying to be the hero. You’re trying to be the guy who still has money in 2040. That’s the win.