Personal Finance: Manage Money, Build Security, and Avoid Common Mistakes

When you think about personal finance, how you manage your money day to day to meet goals, handle surprises, and avoid stress. Also known as individual finance, it’s not about being rich—it’s about being in control. Most people don’t need fancy investments or stock tips. They need to stop living paycheck to paycheck, understand what’s really hurting their credit score, a number lenders use to decide if they’ll trust you with money, and know how to bounce back when something unexpected happens.

Your credit score isn’t just a number on a screen. It affects your car loan rates, your apartment application, even your phone plan. But you don’t need to carry debt to build it. Tools like earned wage access, a way to get part of your paycheck before payday without borrowing can help you avoid late payments that drag your score down. And when you do get hit with a big expense—like a broken down car or an emergency medical bill—your emergency fund, cash set aside just for surprises, not for vacations or new gadgets is your real safety net. Without it, you’re one missed paycheck away from debt.

Rebuilding after a financial setback isn’t magic. It’s a step-by-step process: figure out what you owe, cut what you can, protect what’s left, and slowly rebuild your buffer. You don’t need to be a financial expert—you just need a clear plan. That’s where tools like credit monitoring apps, free or low-cost tools that track your score and tell you exactly what’s changing it come in. They don’t fix your score, but they show you what to fix next. And when you’re stuck, knowing how others recovered—step by step, without more debt—can make all the difference.

What you’ll find below isn’t theory. These are real stories, real tools, and real plans from people who’ve been where you are. Whether you’re trying to stop credit score drops, rebuild after a financial shock, or just understand what’s really affecting your money, the guides here give you what works—no fluff, no jargon, just what you need to move forward.

Certificates of Deposit (CDs): Emergency Fund Ladders Made Simple

A CD ladder lets you earn high interest on your emergency fund while still having access to cash every few months. Learn how to build one in 2026 with real rates, real numbers, and smart tips.

Earned Wage Access vs. Payday Loans: Which One Actually Helps You Stay Out of Debt?

Earned wage access lets you get your own pay early with minimal fees - no interest, no debt. Payday loans trap you in cycles of high-cost borrowing. Learn the real difference and how to avoid predatory lending.

Saving Money with Fintech: Best Tools and Real Strategies for 2025

Discover how fintech tools automate saving, cut hidden fees, and help you build real financial security - without needing to be a budgeting expert. Best apps for 2025.

Shared Wallets and Joint Budgets: How Couples Can Manage Money Together Without the Fight

Learn how shared wallets and joint budgets help couples manage money without fights. Discover the best apps, real strategies, and why transparency builds trust - not control.

EWA and Credit Scores: Does Early Pay Impact Your Credit Score?

EWA doesn't directly affect your credit score, but it can help you avoid late payments that hurt it. Learn how on-demand pay protects your finances without building credit.

Best Credit Score Monitoring Apps with Real Alerts and Score Factors Explained

Learn which credit score monitoring apps give you real FICO scores, accurate alerts, and clear explanations of what's affecting your credit. Find the best free and paid options for your goals.

Rebuilding After a Major Expense: Step-by-Step Plan to Restore Your Finances

Recover from a major financial setback with a clear, step-by-step plan. Learn how to assess damage, build a survival budget, crush debt, rebuild your emergency fund, and get help when you need it-all without going further into debt.

How to Avoid Analysis Paralysis and Start Investing Today

Stop over-researching and start investing today with simple, proven steps. Learn how to overcome analysis paralysis, set clear rules, and begin with just $50 in a low-cost index fund.

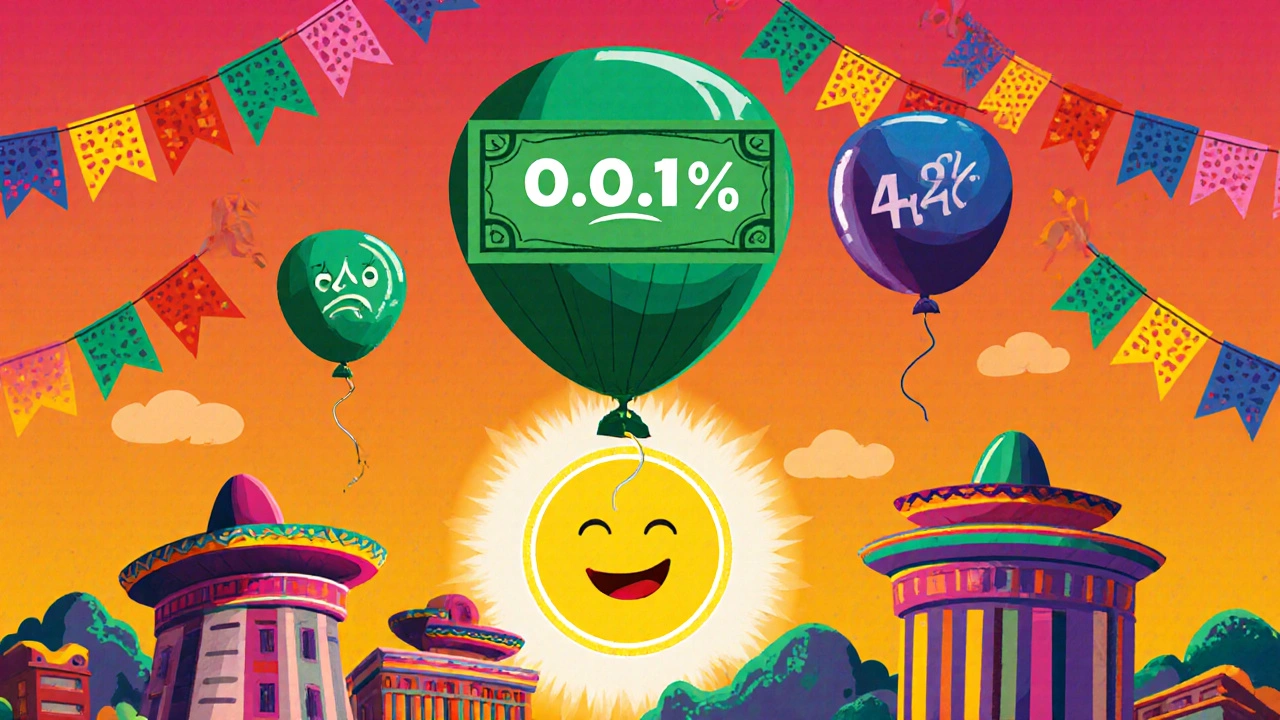

Broker Cash Sweeps: FDIC Programs and Interest Rates Explained

Discover how broker cash sweeps work, why interest rates vary from 0.01% to over 4%, and how to maximize your FDIC coverage and earnings on idle brokerage cash.