Third-Party Data Access: How External Sources Shape Your Financial Decisions

When you use a budgeting app, link your bank account, or sign up for a loan comparison tool, you’re giving third-party data access, the permission for external services to pull your financial information from banks, brokers, or payment platforms. Also known as data aggregation, it’s the invisible engine behind most modern finance apps—letting them see your spending, income, and balances so they can give you better advice, alerts, or savings tips. But this isn’t just convenience. It’s a trade-off. Every time you allow a third party to access your data, you’re handing over control—and sometimes, that control gets sold, shared, or misused without your knowledge.

Companies like Plaid, Yodlee, and MX use data aggregation, the process of collecting and combining financial data from multiple sources into a single view to power apps you trust. But behind the scenes, this data flows through layers of intermediaries. Some use it to improve your credit score. Others use it to target ads. And some? They sell it to data brokers who build profiles on millions of people—profiles that can affect loan approvals, insurance rates, or even job applications. You don’t need to be a tech expert to understand this: if you didn’t directly pay for the service, you’re not the customer—you’re the product. That’s why data privacy, the right to control who sees your financial information and how it’s used matters more than ever. The same tools that help you track spending can also expose you to fraud, identity theft, or algorithmic bias if they’re not properly secured.

Look at the posts here. You’ll find real examples of how third-party data access shows up in everyday finance. From biometric authentication protecting your login to AI credit models using your transaction history to decide if you qualify for a loan, it’s all connected. Broker cash sweeps rely on data feeds to move your money. Mobile payment apps use third-party verification to approve transactions. Even BNPL services check your bank activity before letting you buy now and pay later. These aren’t edge cases—they’re the norm. And if you’re not aware of what data is being shared, you’re leaving money, security, and control on the table.

There’s no need to stop using these tools. But you do need to know how they work, who has your data, and what rights you have. The posts below give you clear, no-fluff breakdowns of how data flows in finance—and how to protect yourself without giving up the convenience. You’ll learn what to look for in terms of permissions, what red flags mean, and how to spot when your data is being used in ways you didn’t agree to. This isn’t about fear. It’s about power. And with the right knowledge, you can use third-party data access to your advantage—not the other way around.

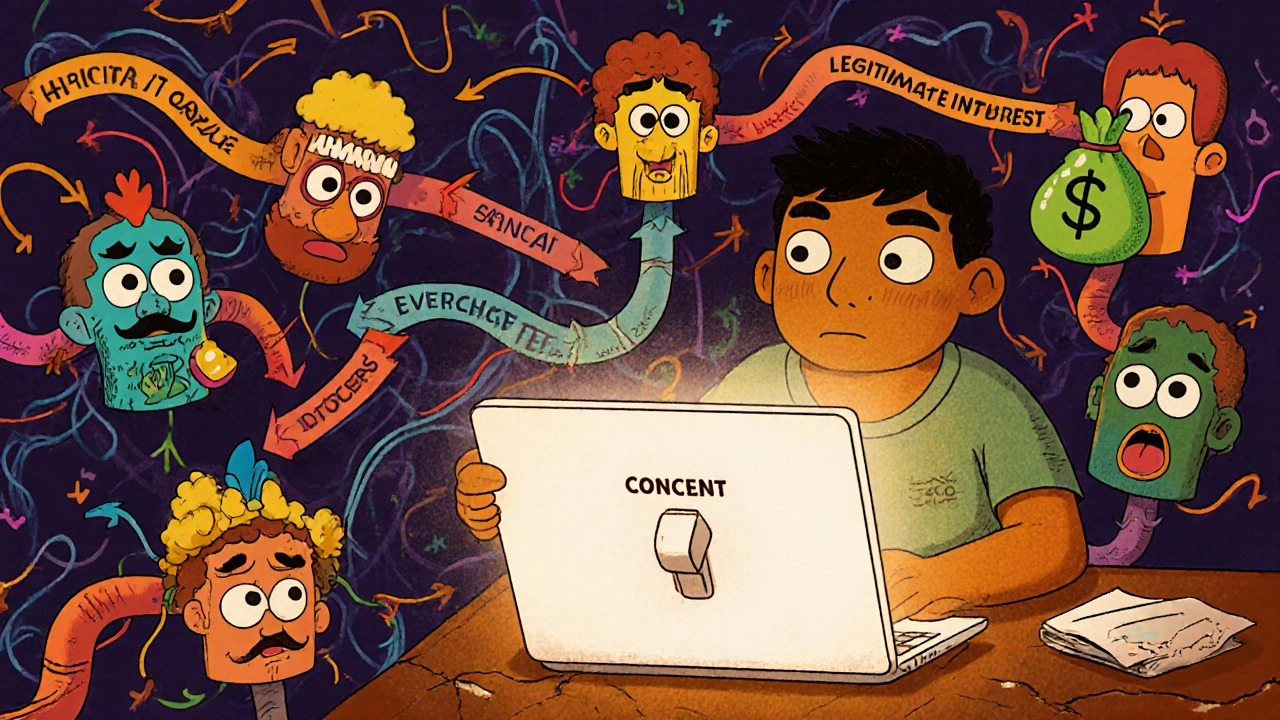

Consent Management: Controlling Third-Party Access to Data in Open Banking

Learn how consent management controls who gets your financial data in open banking, why third-party access is a major privacy risk, and what you can do to protect your information under GDPR and CPRA.