Open Banking: How Shared Financial Data Is Changing How You Bank

When you hear open banking, a system that lets you securely share your financial data with third-party apps using standardized APIs. Also known as financial data sharing, it’s not about giving strangers access to your account—it’s about giving you control over who sees what and when. Before open banking, your bank held all your transaction history, account balances, and payment info behind locked gates. You could only see it through their app or website. Now, with your permission, apps like budgeting tools, loan comparators, and investment platforms can pull that data directly—without you logging into your bank or typing in passwords.

This shift changes everything. fintech APIs, the secure digital bridges that connect your bank to outside apps make it possible. These aren’t hacks or screen scrapers—they’re regulated, encrypted connections approved by financial authorities in the U.S., UK, EU, and beyond. That means if an app goes rogue, there’s accountability. And if your data gets leaked, you’re protected under strict rules. Meanwhile, bank data access, the right you hold to authorize who uses your financial information is now a legal right in many places, not a perk. You’re not just a customer—you’re the owner of your data.

Open banking doesn’t just make life easier. It saves you money. Imagine getting a personal loan offer that’s 3% lower because the lender sees your steady income and low debt—not just your credit score. Or having your spending app automatically categorize every transaction, flagging weird charges before you even notice. Or seeing your savings rate improve because a tool connects your checking, savings, and investment accounts and tells you exactly where to move cash for better returns. This isn’t sci-fi—it’s happening right now, and it’s growing fast.

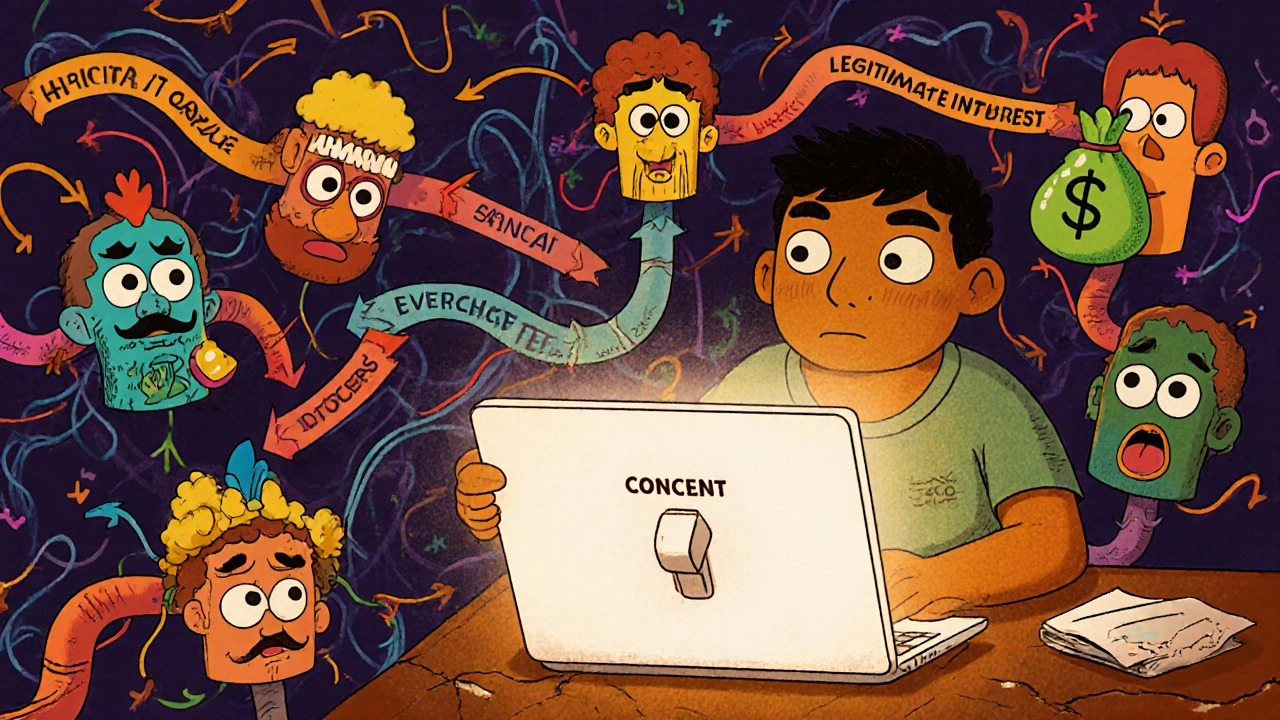

But it’s not all smooth sailing. Some apps ask for more access than they need. Others don’t explain what they’re doing with your data. And if you’re not careful, you could accidentally grant permissions you didn’t mean to. That’s why knowing what open banking really means—what you’re sharing, who you’re sharing it with, and how to revoke access—is more important than ever.

Below, you’ll find real guides on how open banking affects your daily money moves—from how biometric logins protect your data to how digital wallets and broker cash sweeps are starting to integrate with it. You’ll see how AI-driven credit models rely on this data, how BNPL services use it to approve loans faster, and why the future of personal finance isn’t about more apps—it’s about smarter connections between the ones you already use.

Consent Management: Controlling Third-Party Access to Data in Open Banking

Learn how consent management controls who gets your financial data in open banking, why third-party access is a major privacy risk, and what you can do to protect your information under GDPR and CPRA.