GDPR Compliance: What You Need to Know for Global Investing

When you invest through platforms based in Europe—or even just handle data from EU residents—you’re dealing with GDPR compliance, the European Union’s strict data protection law that governs how personal information is collected, stored, and used. Also known as the General Data Protection Regulation, it applies to any company offering goods or services to people in the EU, no matter where the company is based. This isn’t just a legal formality. If you use a broker, fintech app, or financial advisor that handles your name, address, ID number, or even your trading history, GDPR shapes how securely that data is kept—and what rights you have over it.

That means if you’re an investor outside the EU but using a platform like Interactive Brokers, DEGIRO, or even a U.S.-based app that serves EU clients, you’re covered by GDPR rules. These rules force companies to get your clear permission before collecting data, limit how long they can keep it, and give you the right to see, correct, or delete your information. For financial services, this affects everything from account sign-up forms to how brokers share your data with third-party analytics tools. It also impacts data privacy, the broader concept of protecting personal and financial information from misuse or unauthorized access. If a platform doesn’t comply, it can face fines up to 4% of its global revenue—and you could be left vulnerable if your personal details get leaked.

GDPR compliance also connects directly to how financial tech tools operate. For example, if a broker uses biometric authentication, like fingerprint or face recognition to verify your identity, they must prove they’re storing that sensitive data securely and only for as long as needed. The same applies to mobile payment security, digital wallets, or any system that collects your transaction patterns. Even if you’re not in Europe, GDPR sets a global standard—many U.S. and Asian platforms now follow its rules simply because it’s the safest way to protect user data worldwide.

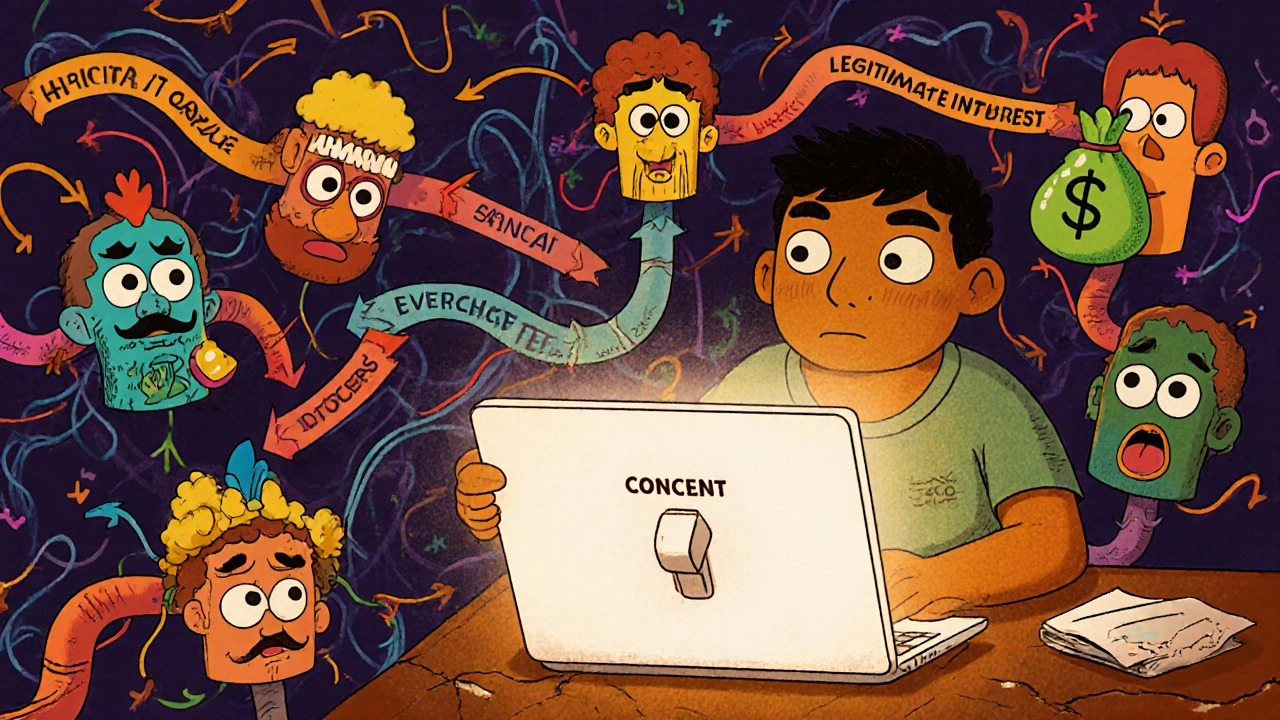

What does this mean for you as an investor? You’re not just buying stocks—you’re sharing your identity. GDPR gives you control over that. You can request a copy of your data, ask for errors to be fixed, or demand deletion if you close your account. It also means platforms can’t sell your trading habits to advertisers or use your personal info for marketing without your consent. That’s a big shift from older systems where your data was treated like a free asset.

Below, you’ll find real-world examples of how GDPR affects fintech tools, broker platforms, and your day-to-day investing. From how your broker handles your ID documents to why some apps won’t let you sign up unless you’re over 16, these posts break down the practical side of data protection—so you know exactly what’s being done with your information, and how to protect yourself.

Consent Management: Controlling Third-Party Access to Data in Open Banking

Learn how consent management controls who gets your financial data in open banking, why third-party access is a major privacy risk, and what you can do to protect your information under GDPR and CPRA.