Data Privacy: Protect Your Financial Info in a Digital World

When you use a digital wallet, apply for a loan, or even scan your face to log into your brokerage app, you're handing over sensitive data privacy, the right to control how your personal and financial information is collected, used, and shared. Also known as financial data security, it's not a feature—it's your baseline expectation. If a company can track your spending habits, access your fingerprints, or predict your credit risk using AI, they owe you transparency and protection. Too many platforms treat your data like a product to sell, not a trust to earn.

That’s why biometric authentication, using your body—like fingerprints or facial features—to verify identity. Also known as Touch ID or Face ID, it’s faster than passwords but not foolproof matters. A hacked password can be changed. A stolen fingerprint can’t. And when digital wallet safety, the measures that protect your payments in apps like Apple Pay, Google Pay, and Cash App. Also known as mobile payment security, it’s critical for everyday transactions fails, you lose money fast. Meanwhile, AI credit bias, when automated lending systems unfairly deny loans based on race, zip code, or gender. Also known as algorithmic lending bias, it’s a hidden risk in modern finance is quietly shaping who gets approved for credit—and who doesn’t. Regulators are starting to act, but you can’t wait for them to fix it.

You don’t need to be a tech expert to protect yourself. You just need to know where your data goes, who’s responsible for it, and what red flags to watch for. That’s what this collection is for. Below, you’ll find real breakdowns of how biometrics work (and where they leak), how fintech apps handle your cash, what hidden fees and biases hide in plain sight, and how to spot when your financial info is being used against you. No fluff. No theory. Just what you need to keep your money and identity safe in a world that’s always watching.

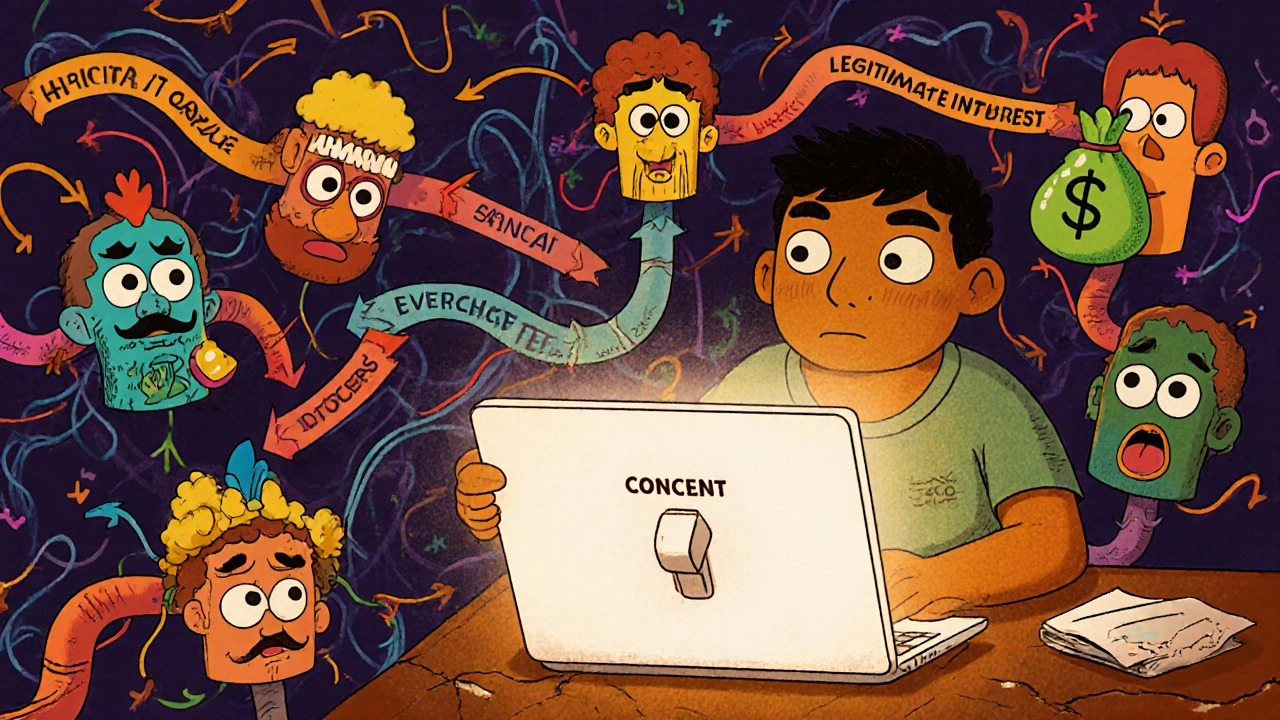

Consent Management: Controlling Third-Party Access to Data in Open Banking

Learn how consent management controls who gets your financial data in open banking, why third-party access is a major privacy risk, and what you can do to protect your information under GDPR and CPRA.