Consent Management: What It Is and Why It Matters for Your Financial Data

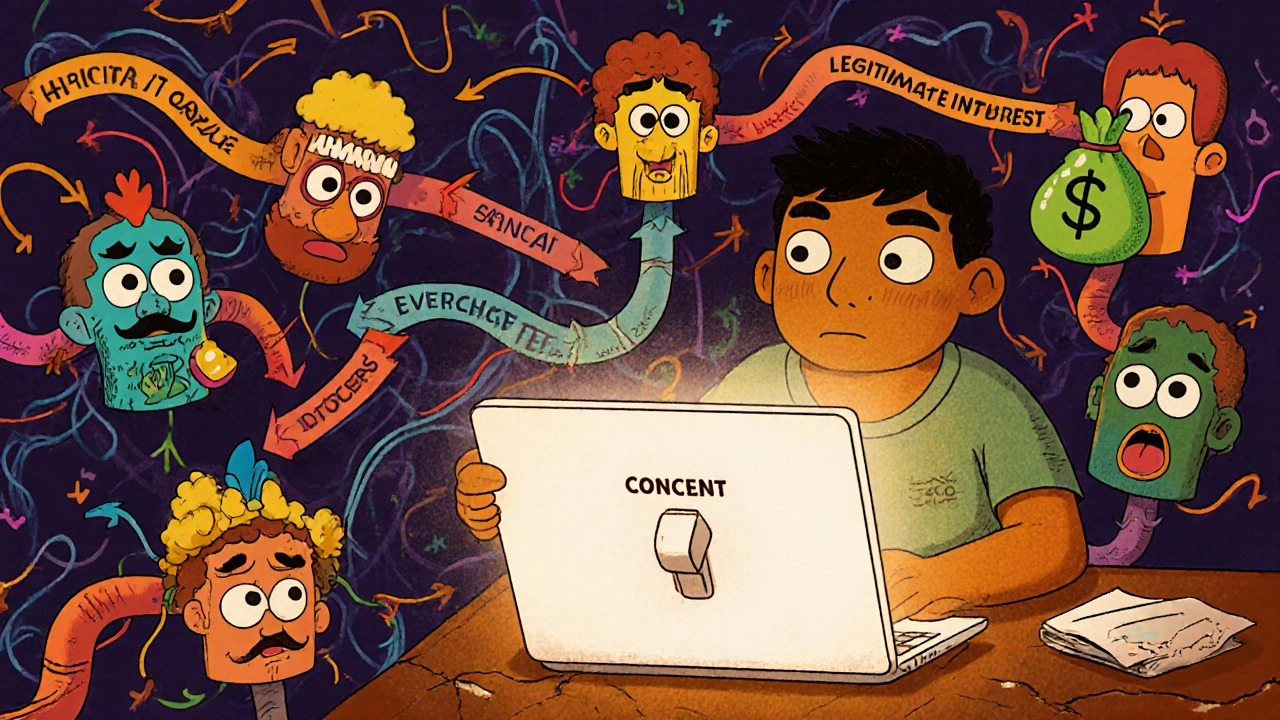

When you sign up for a new investment app, accept a broker’s terms, or link your bank to a budgeting tool, you’re giving consent management, the system that lets companies ask for your permission before using your personal or financial data. Also known as data permissioning, it’s not just a checkbox — it’s the gatekeeper between your money and who gets to see it. Without clear consent rules, your transaction history, biometrics, income, and even your credit behavior can be sold, shared, or analyzed without you knowing.

Behind every app that tracks your spending, every broker that uses facial recognition to log you in, and every fintech that offers earned wage access is a data privacy, the practice of protecting personal information from misuse or unauthorized access framework. And consent management is its foundation. If you’ve ever wondered why Apple Pay asks for permission to use your fingerprint, or why a neobank lets you freeze your card with a tap, it’s because of these rules. They’re not optional — they’re required by laws like GDPR, the European Union’s strict data protection law that gives users control over how their data is collected and used and CCPA, California’s law that lets residents see, delete, or opt out of the sale of their personal data. These aren’t just European or Californian rules anymore. Global fintechs follow them because they serve customers worldwide.

Consent management isn’t about privacy fanatics or tech lawyers. It’s about you. Every time you use a mobile wallet, trade stocks online, or let a finance app automate your savings, you’re handing over data. Who owns that data? Can they sell it? Can they use it to influence your credit score? The answers depend on whether consent was properly obtained — and whether you understand what you’re agreeing to. That’s why the posts here cover everything from biometric authentication and broker cash sweeps to AI bias in lending and mobile payment security. They all tie back to one question: Do you control your data, or does your app? Below, you’ll find real guides on how to read the fine print, spot hidden permissions, and take back control — without needing a law degree.

Consent Management: Controlling Third-Party Access to Data in Open Banking

Learn how consent management controls who gets your financial data in open banking, why third-party access is a major privacy risk, and what you can do to protect your information under GDPR and CPRA.