Commission Cost Calculator

How Hidden Commissions Impact Your Investments

This calculator shows how commission-based compensation can cost you over time. Input your investment details to see the difference between commission-based products and low-cost index funds.

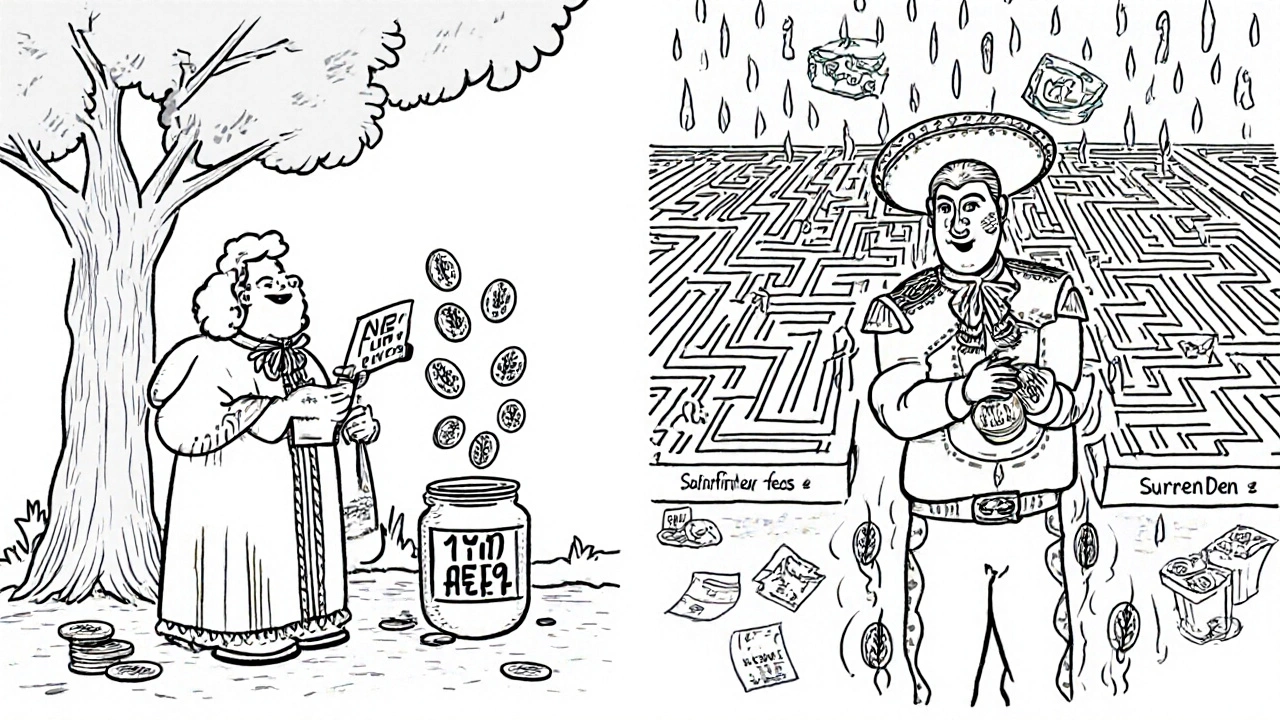

When you hire a financial advisor, you expect them to have your best interests at heart. But what if their paycheck depends on pushing products that aren’t right for you? That’s the reality for millions of people working with commission-based financial advisors. These advisors don’t charge you a flat fee. Instead, they earn money every time they sell you an investment, insurance policy, or annuity. And that creates a problem-one that’s built into the system.

How Commission-Based Advisors Get Paid

Commission-based advisors make money through sales. Every time they recommend a mutual fund with a front-end load, an annuity with a high surrender charge, or an insurance product with a large upfront payout, they get a cut. These payments come from the companies that make the products, not from you directly. But you’re still paying-just in a way that’s hidden.Common commission structures include:

- Upfront sales loads: A percentage taken out of your initial investment when you buy a fund. This can be 3% to 5% or more.

- Trailing commissions: Ongoing payments-sometimes 0.5% to 1% per year-paid to the advisor as long as you hold the product. These are often called "revenue sharing" or "retrocessions."

- Revenue sharing: Fund managers pay the advisor’s firm for placement on their preferred list. That firm then shares part of that money with the advisor.

These payments aren’t optional. They’re baked into the product’s cost. And because they’re not always clear on your statements, most people don’t realize they’re paying them.

The Conflict Is Built In

Here’s the core issue: if an advisor earns more by selling Product A than Product B, they’re more likely to recommend Product A-even if Product B is a better fit for your goals, risk tolerance, or timeline.

Think of it this way: if you’re a doctor who gets paid more for prescribing a specific brand of painkiller, you might start recommending it even when a cheaper, equally effective generic would work better. That’s not malpractice-it’s incentive. And that’s exactly what’s happening in financial advice.

According to the Consumer Federation of America, these conflicts aren’t accidental. They’re "the natural outgrowth of commission-based compensation structures." Advisors aren’t necessarily dishonest. They’re just responding to the system they work in.

And it gets worse. Many commission-based advisors work for banks, brokerages, or insurance companies that only offer their own proprietary products. These firms design products that pay higher commissions-not because they’re better for you, but because they’re more profitable for the company. You’re not getting access to the full market. You’re getting access to what pays the advisor best.

Fee-Only vs. Fee-Based: The Big Difference

Many advisors call themselves "fee-based," which sounds like they charge you directly. But that term is misleading. A "fee-based" advisor can still earn commissions. A "fee-only" advisor cannot. That’s the critical distinction.

- Fee-only advisors are paid only by you-either hourly, monthly, or as a percentage of assets you have with them. They don’t get kickbacks from product makers. They’re legally required to act as a fiduciary, meaning they must put your interests above their own.

- Fee-based advisors charge you a fee but also earn commissions. This creates a dual incentive: they want you to pay them, but they also want you to buy products that pay them extra.

Even fee-only advisors aren’t perfect. Charging 1.5% on stocks and 0.5% on bonds might push them to overweight your portfolio in equities-even if bonds are more appropriate for your age or risk profile. But at least their income isn’t tied to how often you buy or sell. That’s a big difference.

Red Flags to Watch For

You don’t need a finance degree to spot trouble. Here are five clear warning signs:

- Your advisor works for a bank, brokerage, or insurance company. These firms have their own products that pay higher commissions.

- They recommend annuities without explaining why. Annuities often come with 5% to 7% commissions and complex surrender penalties. They’re rarely the best solution for most people.

- They use phrases like "this is a great opportunity" or "limited-time offer." Real advice doesn’t come with sales pressure.

- You can’t find clear fee disclosures. If your statements don’t break down commissions, ask for Form ADV Part 2. It’s required by law.

- They say they’re "fiduciary" but don’t put it in writing. Fiduciary duty isn’t a marketing term. It’s a legal obligation. If they won’t sign a fiduciary oath, don’t trust the label.

What Regulators Are (and Aren’t) Doing

In 2020, the SEC introduced Regulation Best Interest (Reg BI) to raise the bar for brokers. It required them to act in your "best interest"-but didn’t make them fiduciaries. That’s a major loophole.

Here’s the truth: Reg BI doesn’t ban commissions. It doesn’t force advisors to disclose every conflict. It just says they shouldn’t put their interests ahead of yours. But with no clear definition of "best interest," enforcement is weak. In 2022 alone, the SEC filed 27 enforcement actions against advisors for undisclosed conflicts. That’s not a sign of a healthy system-it’s proof the problem is widespread.

Meanwhile, Form ADV filings-the official disclosures advisors must submit to regulators-show a 22% increase in conflict disclosures from 2022 to 2023. That’s not because advisors are becoming more honest. It’s because regulators are catching more of them.

How to Protect Yourself

If you’re working with a commission-based advisor, here’s what to do now:

- Ask how they’re paid. Say: "Do you earn commissions from the products you recommend? If so, which ones?" Write down their answer.

- Request Form ADV Part 2. This document lists all fees, conflicts, and disciplinary history. If they refuse, walk away.

- Check your account statements. Look for terms like "sales charge," "load," "12b-1 fee," or "trailer fee." These are commissions in disguise.

- Compare your returns to low-cost index funds. If your portfolio is underperforming the S&P 500 by more than 1% annually after fees, you’re likely paying too much for advice.

- Consider switching to a fee-only advisor. Fee-only advisors who charge 1% or less of assets under management are far more common than you think. The CFA Institute found 68% of them charge 1% or less.

The Bottom Line

Commission-based financial advice isn’t broken-it’s designed to benefit the advisor, not the client. The system rewards salesmanship over sound planning. It hides costs. It limits choices. And it puts your financial future at risk.

That doesn’t mean all commission-based advisors are bad. Some do good work despite the system. But the structure itself makes it harder for them to do right by you. And if you’re unaware of how they’re paid, you’re already at a disadvantage.

Financial advice should be about your goals, not someone else’s commission. If you want advice that’s truly aligned with your interests, demand transparency. Ask hard questions. And if the answer doesn’t satisfy you, find someone who will.

Are commission-based financial advisors illegal?

No, commission-based advisors are not illegal. They operate under a "suitability" standard, which means they must recommend products that are suitable for your financial situation-not necessarily the best or cheapest ones. This is different from the fiduciary standard, which requires advisors to act in your best interest. While legal, the commission model creates strong financial incentives that often conflict with your goals.

Can I trust an advisor who says they’re a fiduciary?

Not necessarily. Some advisors call themselves fiduciaries but still earn commissions. True fiduciaries are typically fee-only and must legally put your interests first. Ask for a written fiduciary oath or check if they’re registered as an investment adviser with the SEC. If they’re only registered as a broker-dealer, they’re not held to a fiduciary standard-even if they say they are.

Why do advisors push annuities so hard?

Annuities often pay the highest commissions-sometimes 5% to 7% of the investment amount. That’s thousands of dollars for a single sale. Even though annuities come with high fees, surrender penalties, and complex terms, they’re profitable for advisors. That’s why they’re pushed so aggressively, especially to retirees. Always ask: "What’s the alternative? Why is this better than a low-cost mutual fund or bond ladder?"

How do I know if I’m being overcharged?

Compare your total annual costs to a simple index fund portfolio. If you’re paying more than 1.5% in combined fees (including commissions, expense ratios, and advisory fees), you’re likely overpaying. Most fee-only advisors charge 0.5% to 1% of assets. If your advisor’s products have loads, 12b-1 fees, or surrender charges, add those in. If your net return is below market averages after fees, you’re paying too much.

Is it better to work with a fee-only advisor?

For most people, yes. Fee-only advisors are legally bound to act as fiduciaries and can’t earn commissions from product sales. This removes the biggest conflict of interest in financial advice. They’re paid to help you plan-not to sell you something. While they may charge a percentage of your assets, their incentives are aligned with your long-term growth, not short-term sales.

Laura W

November 17, 2025 AT 11:16Okay but like-why do people still use commission-based advisors? I got roasted by my bank’s ‘financial consultant’ last year when I found out I was paying 4.5% just to buy an S&P fund that literally exists for 0.03%. I switched to a fee-only planner and my portfolio’s been growing faster AND I sleep better. Also, annuities? Bro. They’re the financial equivalent of a timeshare. Don’t touch them unless you’re trying to fund someone else’s vacation.

Graeme C

November 18, 2025 AT 15:54Let me be blunt: this entire system is a regulatory farce. Regulation Best Interest? More like Regulation ‘Let’s Keep the Commission Flowing.’ The SEC’s enforcement actions are a joke-27 cases in a year out of tens of thousands of advisors? That’s like catching one drunk driver in a city of a million. And don’t get me started on ‘fee-based’ being used interchangeably with ‘fee-only.’ It’s linguistic sleight-of-hand designed to confuse retail investors. If you’re not signed to a fiduciary oath in writing, you’re not protected. Period.

Astha Mishra

November 20, 2025 AT 13:54It is fascinating, really, how deeply embedded capitalism has become in the very architecture of trust. We are told to rely on experts for our most vulnerable financial decisions, yet the incentive structure is designed to exploit our ignorance. The advisor who recommends an annuity with a 7% commission is not evil-they are merely a product of a system that rewards salesmanship over wisdom. And yet, we continue to place our life savings in the hands of those whose success is measured not by our growth, but by their commission statements. Perhaps the real question is not whether we should avoid commission-based advisors, but whether we can ever truly reform a system where profit and protection are locked in eternal conflict. I do not have the answer-but I am asking.

Julia Czinna

November 20, 2025 AT 17:08I used to work with a commission guy. Didn’t realize I was paying 2% in hidden fees until I did a side-by-side comparison with a Vanguard index fund. My portfolio was basically paying for his BMW. Switched to a fee-only advisor last year-zero sales pitches, just a simple 0.7% fee. I haven’t looked back. Also, Form ADV? Request it. It’s like a credit report for your advisor. If they hesitate, run.

Kenny McMiller

November 21, 2025 AT 08:15Trailing commissions are the quiet killer. You think you’re just paying a management fee, but that 0.75% ‘revenue share’ going to your advisor? That’s your money disappearing every year, compounding into tens of thousands over a decade. And nobody tells you. It’s like your car’s oil change is secretly billed to you by the mechanic who gets a kickback from the oil brand. We need a ‘fee transparency’ law-like nutrition labels, but for financial products. ‘This fund pays your advisor $1,200 this year. Buy at your own risk.’