Wise Transfer Cost Calculator

Compare Your Transfer Costs

See exactly how much you'll save by using Wise instead of a traditional bank

Imagine sending $3,000 to your family in Mexico. Your bank says it’ll take five days and cost $75 - plus a secret fee hidden in the exchange rate that eats another $90. You’re left wondering: Why does this cost so much?

That’s the problem Wise fixed.

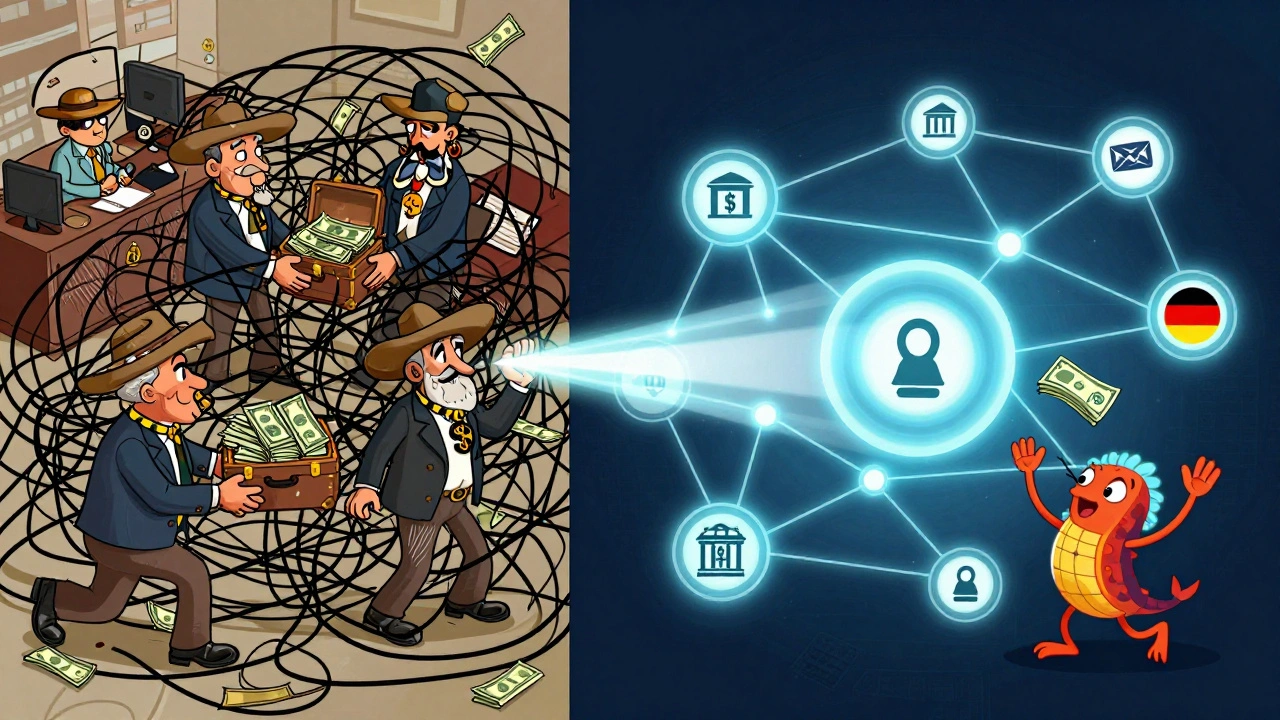

Before Wise, international money transfers were a mess. Banks used to route your money through three or four middlemen, each taking a cut. They’d pretend to give you the real exchange rate, then slip in a 3% to 5% markup. You didn’t know how much you were losing until you checked your bank statement days later.

Wise changed that. Founded in 2011 by two guys tired of overpaying to send money abroad, it didn’t just tweak the system - it rebuilt it from the ground up.

How Wise Actually Works (No Hidden Chains)

Wise doesn’t send your money across borders like a traditional bank. Instead, it uses a clever trick: local bank accounts.

Let’s say you’re in the U.S. and want to send €2,000 to Germany. You deposit USD into Wise’s U.S. bank account. Meanwhile, someone in Germany is sending USD to a friend in the U.S. Wise matches those two transfers. Your friend in Germany gets €2,000 from Wise’s local German account. The money never crosses the Atlantic. No SWIFT fees. No middlemen. Just a direct, local payment.

This system cuts costs dramatically. Traditional banks charge $40-$60 for a $3,000 transfer. Wise? Around $15. And you see every fee upfront - no surprises.

Wise uses the real exchange rate - the mid-market rate you see on Google or XE.com. No markups. No tricks. If the rate is 1 USD = 0.92 EUR, that’s exactly what you get.

Speed That Actually Matters

Speed isn’t just a bonus with Wise - it’s the norm.

For card-funded transfers, 70% of payments arrive in under 20 seconds. Even bank-funded transfers (like ACH) usually land in under 24 hours. Compare that to traditional banks, where a transfer can take 3-5 business days - and sometimes longer if it gets stuck in a compliance hold.

Why so fast? Because Wise skips the global banking chain. No intermediary banks. No manual processing. Just automated, peer-to-peer matching on a global scale.

One user in Colorado sent $5,000 to their sister in Poland using Wise. The money arrived in 11 minutes. Their bank had taken four days for the same amount last year.

More Than Just Transfers - A Real Financial Tool

Wise isn’t just a money transfer app. It’s becoming a full financial platform.

The Wise Account lets you hold and manage 50+ currencies in one place. You can receive payments in EUR, GBP, AUD, or MXN - and convert between them instantly at the real exchange rate. No more juggling separate bank accounts for each country.

And here’s the kicker: you earn 3.4% APY on your USD balance. That’s not a gimmick. It’s real interest, backed by FDIC insurance up to $250,000 through Wise’s partner bank. Compare that to the 0.01% you get at most traditional banks.

Then there’s the Wise Multi-Currency Card. Use it to spend in over 160 countries. When you buy coffee in Tokyo or pay for a hotel in Brazil, it converts your money at the mid-market rate - no foreign transaction fees. No more being charged 3% just for using your card abroad.

Businesses love this too. Freelancers, e-commerce sellers, and small teams use Wise to get paid in foreign currencies, pay overseas contractors, and even invoice clients using local bank details. It integrates with Xero, QuickBooks, and Stripe - so bookkeeping stays clean.

Who It’s For (And Who It’s Not)

Wise shines for people who:

- Send money regularly to family or friends abroad

- Work remotely and get paid in foreign currencies

- Travel often and want to avoid ATM fees and bad exchange rates

- Run a small business with international clients or suppliers

But it’s not perfect for everyone.

If your recipient doesn’t have a bank account - say, they’re in a rural area in Nigeria or the Philippines - Wise won’t help. You can’t send cash pickup transfers like Western Union or MoneyGram. Wise only deposits to bank accounts.

And while Wise is fast, it’s not instant for every payment type. ACH transfers take 1-2 days. Card payments are lightning-fast, but not everyone wants to use a card to send large amounts.

Also, during currency crises - like when the Turkish lira crashes or the Argentine peso plunges - Wise’s matching system can slow down. If too many people are sending USD to one country and not enough are sending back, Wise has to buy currency on the open market. That can mean slightly higher fees or delays.

Transparency That Builds Trust

Wise’s biggest advantage isn’t technology - it’s honesty.

Every transfer shows you:

- Exact exchange rate (updated every minute)

- Total fee before you confirm

- Estimated delivery time

- Breakdown of what the recipient will get

There’s no fine print. No “additional charges may apply.” You know exactly what you’re paying - and what your recipient will receive.

That’s why 4.3 out of 5 stars on Trustpilot from over 48,000 reviews isn’t a fluke. People aren’t just satisfied - they’re loyal.

One Reddit user saved $187 on a €5,000 transfer to Germany. Another said, “I used to pay $120 to send money to my parents in India. Now I pay $22. I don’t use my bank for anything international anymore.”

How It Compares to the Competition

Here’s how Wise stacks up against the big names:

| Feature | Wise | Traditional Bank | PayPal (Xoom) |

|---|---|---|---|

| Exchange Rate Markup | 0% | 3-5% | 2-4% |

| Transfer Fee (for $3,000) | $15-$20 | $40-$75 | $25-$40 |

| Speed (Card-funded) | Under 20 seconds | 2-5 days | 1-3 days |

| Receive in Bank Account Only? | Yes | Yes | Yes |

| Cash Pickup Available? | No | No | Yes |

| Multi-Currency Account | Yes | No | No |

| Interest on Balance | 3.4% APY (USD) | 0.01% or less | 0% |

PayPal’s Xoom wins for cash pickup - useful in places where bank access is limited. But if you care about cost, speed, and transparency, Wise is the clear winner.

Revolut and N26 offer similar features, but they’re not as focused on cross-border payments. Wise built its entire business around this one thing - and it shows.

What’s Next for Wise?

Wise isn’t standing still.

In early 2024, they launched business loans for small companies using their transaction history as collateral. That’s huge - it means a freelancer in Brazil or a Shopify store in Canada can get funding without a traditional credit check.

They’re also testing a “Wise Wallet” for emerging markets - a mobile wallet that could let people in India, Nigeria, or Indonesia receive money without needing a bank account. If it rolls out, it could bridge the gap Wise currently can’t reach.

And they’re expanding crypto conversion. You can now buy and sell Bitcoin, Ethereum, and other coins directly in the app - converted at the real rate, with no hidden spreads.

The Real Disruption

Wise didn’t win because it’s tech-heavy. It won because it treated customers like humans.

Traditional banks treated international transfers like a mystery box - you paid, you waited, and you hoped for the best. Wise turned it into a clear, predictable, and fair process.

They forced banks to lower their fees. They made exchange rate markups look shady. They showed that speed and transparency aren’t luxuries - they’re basic expectations.

Today, Wise serves nearly 15 million people. They move £12 billion every month. And they’re still growing - fastest in Asia-Pacific, where remittance needs are huge and trust in banks is low.

It’s not perfect. Customer service can be slow during peak times. Verification can take a few extra days if your ID isn’t clear. But for most people sending money abroad, Wise is the only choice that makes sense.

If you’ve ever felt ripped off by your bank’s international transfer fees - you’re not alone. And now, you have a better way.

Is Wise cheaper than my bank for international transfers?

Yes, almost always. For a $3,000 transfer, Wise typically costs $15-$20, while your bank might charge $40-$75 plus a hidden 3-5% markup on the exchange rate. That’s often $100+ in extra fees. Wise shows you every cost upfront - no surprises.

Can I send money to someone without a bank account using Wise?

No. Wise only sends money to bank accounts. If your recipient doesn’t have one - say, they live in a rural area - you’ll need to use a service like Western Union or MoneyGram that offers cash pickup. Wise doesn’t support cash delivery.

How fast does Wise transfer money?

It depends on how you pay. If you use a card, 70% of transfers arrive in under 20 seconds. If you use a bank transfer like ACH, it usually takes 1-2 business days. Most transfers (95%) are done within 24 hours, even with bank funding.

Does Wise offer interest on my money?

Yes. You earn 3.4% APY on your USD balance in the Wise Account. That interest is backed by FDIC insurance up to $250,000 through Wise’s partner bank. No other money transfer service offers this kind of yield.

Is Wise safe to use?

Yes. Wise is regulated by the Financial Conduct Authority (FCA) in the UK and has equivalent licenses in the U.S., EU, and Asia-Pacific. Your money is held in segregated accounts, meaning it’s protected even if Wise faces financial trouble. The app uses two-factor authentication, encryption, and biometrics to keep your account secure.

Can I use Wise for business payments?

Absolutely. Wise Business lets you get paid in 50+ currencies using local bank details, pay international contractors, and integrate with accounting tools like QuickBooks and Xero. Businesses use it to reduce currency costs, automate payments, and simplify global payroll.

What currencies does Wise support?

Wise supports 50+ currencies for transfers and holds 40+ currencies in your multi-currency account. You can send money to over 160 countries. Popular ones include USD, EUR, GBP, CAD, AUD, INR, MXN, and PHP.

Are there limits on how much I can send?

Yes. Limits depend on your account type, verification level, and destination country. For personal accounts, you can typically send up to $100,000 per transfer. Higher limits are available after additional verification. Business accounts have higher thresholds.

Wise didn’t just make international transfers cheaper - it made them honest. And in a world full of hidden fees and confusing terms, that’s worth more than any discount.

Kenny McMiller

December 5, 2025 AT 13:11Wise is essentially a peer-to-peer liquidity network disguised as a fintech app. What they’ve done is bypass the SWIFT infrastructure by creating localized settlement pools-essentially arbitraging the friction in cross-border capital flows. The mid-market rate isn’t just a gimmick; it’s a structural rebuke to the rent-seeking behavior of legacy banks. You’re not paying for a transfer-you’re paying for network efficiency. And that 3.4% APY? That’s not interest-it’s a yield on idle liquidity they’re rehypothecating through their FDIC-partnered bank. This isn’t disruption. It’s systemic re-architecture.

Dave McPherson

December 7, 2025 AT 12:27Wow. Another woke fintech cultist praising Wise like it’s the second coming. Let me guess-you also think Bitcoin is ‘sound money’ and that your NFT monkey is an ‘investment.’ The truth? Wise’s ‘transparency’ is just a marketing veneer. Their ‘real exchange rate’? Still gets gamed during volatile currency swings. And don’t get me started on how they charge you $15 to send $3k but nickel-and-dime you on tiny conversions. Meanwhile, your uncle in Mumbai still needs cash pickup. Wise doesn’t solve problems-it just makes rich people feel smug about their bank transfers. Also, 3.4% APY? That’s not a feature, it’s a trap waiting for the Fed to hike again.

RAHUL KUSHWAHA

December 8, 2025 AT 19:24Wise helped me send money to my parents in India for the first time without feeling ripped off. 💸 I used to pay $120 with my bank-now it’s $22. And the speed? My mom got it in 10 minutes! 🙏 I still wish they had cash pickup, but for bank accounts, this is the best thing since sliced bread. Thank you, Wise. 🙏

Julia Czinna

December 9, 2025 AT 15:24I’ve been using Wise for over three years now-first for personal transfers, then for my freelance work. The multi-currency account alone saved me hundreds in conversion fees when I got paid in EUR and CAD. The transparency is honestly revolutionary. I remember once checking a transfer before sending and realizing my bank would’ve charged me $110 extra in hidden fees. That’s not just convenience-it’s dignity. And yes, the 3.4% APY is real. I’ve left $8k in my USD balance for six months and earned $230. No other bank I’ve used even comes close. It’s not perfect-customer service can be slow, and verification takes time-but for anyone who moves money internationally, it’s not a tool. It’s a necessity.