VYM Dividend Stock: What It Is, How It Works, and Why Investors Choose It

When you hear VYM, a high-yield dividend ETF from Vanguard that tracks U.S. stocks with strong and growing dividends. Also known as the Vanguard High Dividend Yield Index Fund, it’s one of the most straightforward ways to get paid just for owning shares in stable companies. Unlike growth stocks that bet on future profits, VYM focuses on companies already sending cash back to shareholders—every quarter, no fluff.

This isn’t just about big names like Coca-Cola or Johnson & Johnson. VYM holds over 400 companies, all picked for their history of paying dividends, solid balance sheets, and reasonable valuations. It doesn’t chase the hottest ticker—it looks for steady performers that don’t blink during market drops. That’s why many investors use VYM as the income engine in their portfolio, not just a side bet. It’s not a lottery ticket. It’s a paycheck.

What makes VYM different from other dividend funds? For one, it doesn’t just pick the highest-yielding stocks. It avoids companies with unsustainable payouts. That’s why you won’t see risky REITs or telecoms dominating the list like you might in other funds. It’s built to last. And because it’s a Vanguard fund, the fees are dirt cheap—just 0.06% a year. That means more of your dividends stay in your pocket, not someone else’s.

People who use VYM aren’t trying to get rich quick. They’re building reliable income. Maybe they’re retired and need monthly cash. Maybe they’re saving for a house and want to grow money without taking wild swings. Or maybe they’re just tired of watching their portfolio bounce around and want something that actually pays them while they wait. VYM answers all those needs with one simple holding.

And it’s not just about the yield. VYM’s total return over the last 10 years has beaten the S&P 500 in most periods, not because it grew faster, but because it didn’t fall as hard. When the market dropped in 2020 or 2022, VYM kept paying. That consistency is rare. Most funds promise income but forget to protect your capital. VYM does both.

You’ll find posts here that dig into how VYM compares to other dividend ETFs like VIG or SCHD. You’ll see how it fits with broker cash sweeps, why it’s a better choice than picking individual dividend stocks, and how to use it alongside bond funds or REITs. There’s no hype here—just real data, real strategies, and real investor experiences. Whether you’re new to investing or you’ve held VYM for years, you’ll find something that helps you make smarter decisions.

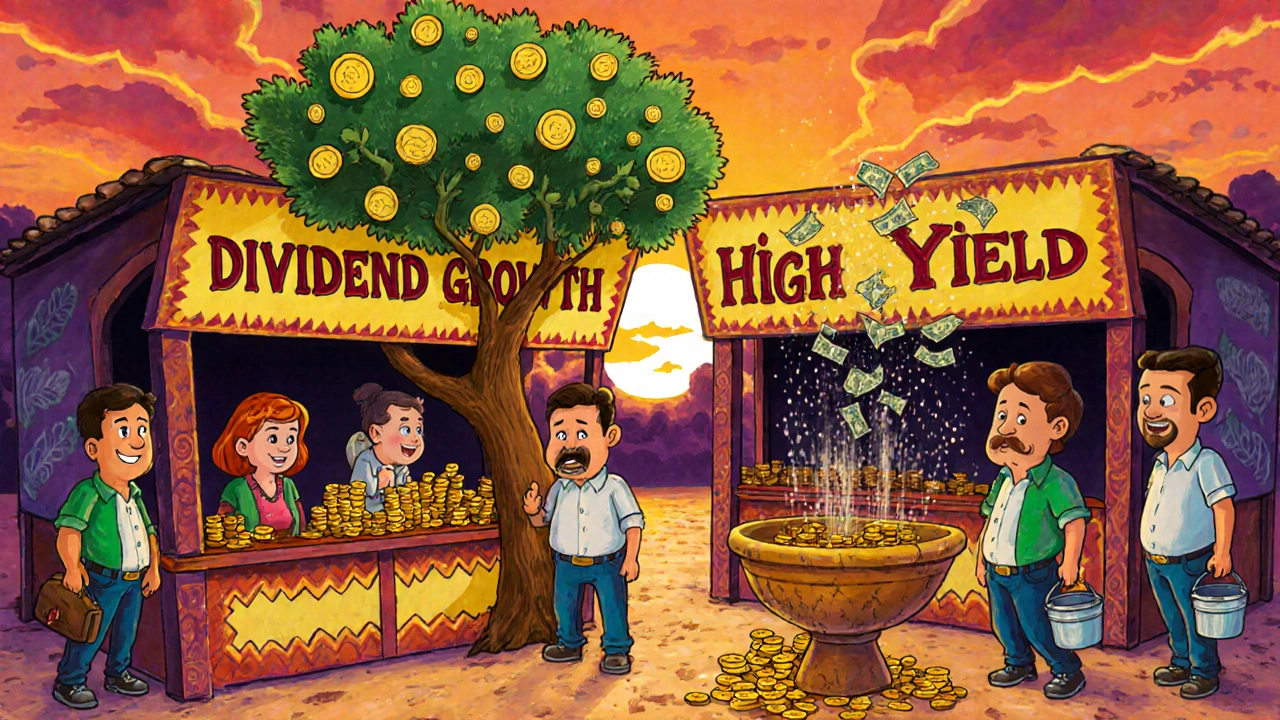

Dividend Growth vs Current Yield: Which Strategy Wins for Long-Term Wealth?

Dividend growth and current yield are two very different paths to income investing. One builds wealth over time. The other gives you cash now - but at a risk. Learn which one suits your goals and why growth often wins long-term.