SCHD Dividend ETF: What It Is, How It Works, and Why Investors Use It

When you hear SCHD, the Schwab U.S. Dividend Equity ETF, a low-cost fund that picks U.S. companies with consistent dividends and solid financial health. Also known as the Schwab Dividend ETF, it’s one of the most straightforward ways to get paid while you invest. Unlike growth stocks that promise future gains, SCHD focuses on companies that actually hand you cash—every quarter. That’s not magic. It’s a strategy built on reliability, not hype.

What makes SCHD different? It doesn’t chase the biggest names just because they’re popular. It looks for companies that have paid dividends for at least 10 years, have strong cash flow, and aren’t drowning in debt. Think Coca-Cola, Johnson & Johnson, and Abbott Labs—not flashy tech startups. The fund holds about 100 stocks, weighted by dividend yield and financial strength, not market cap. That means a smaller company with a 4% yield can carry more weight than a giant with a 1.5% payout. This approach often gives SCHD a higher yield than the S&P 500, usually between 3% and 4%, even when interest rates are low.

It’s not just about the dividend. SCHD also tends to hold companies with lower volatility than the broader market. That’s why so many retirees and cautious investors use it as a core holding. It’s not a get-rich-quick tool. It’s a slow-burn wealth builder. And because it’s managed by Schwab, fees are dirt cheap—just 0.06% annually. That’s less than a coffee a year for every $10,000 you invest.

People often confuse SCHD with other dividend ETFs like VYM or DGRO. But SCHD stands out because it filters for quality first. It avoids companies that might have a high yield but are on shaky ground—like those cutting dividends or carrying too much leverage. That discipline has helped it outperform many peers over the last decade, especially during market pullbacks. When the market drops, SCHD doesn’t just sit there—it often holds up better because the companies inside are cash-rich and still paying.

And here’s the thing: SCHD isn’t just for older investors. Younger people use it too—not because they need the income now, but because they want steady growth with less stress. Reinvesting those dividends over 20 years can turn a modest start into a serious pile of cash. It’s the power of compounding, wrapped in a simple, low-cost package.

You’ll find SCHD mentioned in posts about broker cash sweeps, because many investors keep its dividends parked in sweep accounts earning interest. You’ll see it tied to dividend investing guides, because it’s a go-to example of how to build income without gambling. And you’ll notice it shows up in discussions about blue-chip stocks, since most of its holdings are exactly that—old, stable, and dependable.

There’s no secret sauce. No complex algorithm. Just a clear rule: pick companies that pay well, stay healthy, and don’t overreach. That’s why SCHD keeps showing up in portfolios—even when the market gets wild. If you’re looking for a way to earn while you wait, without chasing every trend, SCHD is one of the cleanest options out there. Below, you’ll find real breakdowns of how it fits into broader investing strategies, what to watch for, and how to use it without falling into common traps.

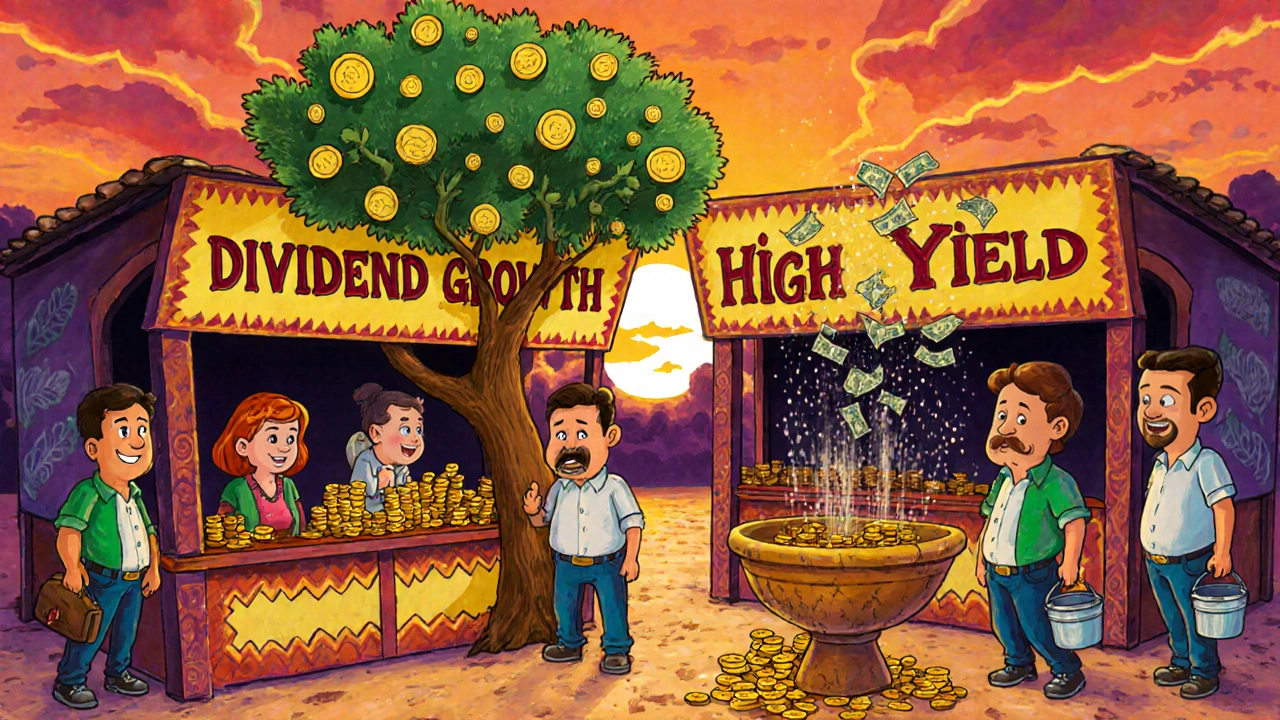

Dividend Growth vs Current Yield: Which Strategy Wins for Long-Term Wealth?

Dividend growth and current yield are two very different paths to income investing. One builds wealth over time. The other gives you cash now - but at a risk. Learn which one suits your goals and why growth often wins long-term.