FDIC Insurance: What It Covers and How It Protects Your Money

When you put money in a bank, you expect it to be there when you need it. That’s where FDIC insurance, a U.S. government program that protects depositors if their bank fails. Also known as Federal Deposit Insurance Corporation coverage, it’s one of the simplest and most powerful tools for protecting your cash. Most people assume their savings are safe—but not all accounts are covered, and not all money is protected. The FDIC doesn’t cover stocks, bonds, mutual funds, crypto, or life insurance policies. It only covers deposit accounts: checking, savings, money market accounts, and certificates of deposit (CDs). If your bank shuts down, the FDIC steps in to return your money—up to $250,000 per depositor, per insured bank, for each account ownership category.

That $250,000 limit sounds high, but it can be easily exceeded if you’re not careful. If you have $300,000 in a single checking account and your bank fails, $50,000 is at risk. But here’s the trick: you can multiply your protection by using different ownership types. A single account, a joint account with your spouse, a revocable trust, and a retirement account each count as separate categories. So if you have $250,000 in a single account, another $250,000 in a joint account with your partner, and $250,000 in an IRA, you’re covered for $750,000 at the same bank. It’s not complicated, but most people don’t know it. And if you’re using multiple banks, make sure each one is FDIC-insured—some online banks are operated by credit unions, which use NCUA insurance instead. You can check a bank’s status on the FDIC’s website, but you shouldn’t have to dig to find out. Reputable banks display the FDIC logo prominently.

FDIC insurance doesn’t just protect your money—it protects your peace of mind. During the 2008 financial crisis, over 500 banks failed. People who understood FDIC coverage kept their savings. Those who didn’t panicked, withdrew cash in a rush, or lost access to funds for days. Even today, with rising interest rates and regional bank volatility, knowing your coverage limits matters more than ever. You don’t need a financial advisor to use FDIC insurance. You just need to know how your accounts are structured. The posts below break down real cases: how to split funds across banks, why joint accounts matter, what happens when a bank gets bought by another, and how to verify your coverage without calling customer service. You’ll also find guides on how to spot fake banks that pretend to be FDIC-insured, and how to use CDARS or ICS networks to protect more than $250,000 in one institution. This isn’t theory. It’s the kind of practical knowledge that keeps your money safe when things go wrong.

Broker Cash Sweeps: FDIC Programs and Interest Rates Explained

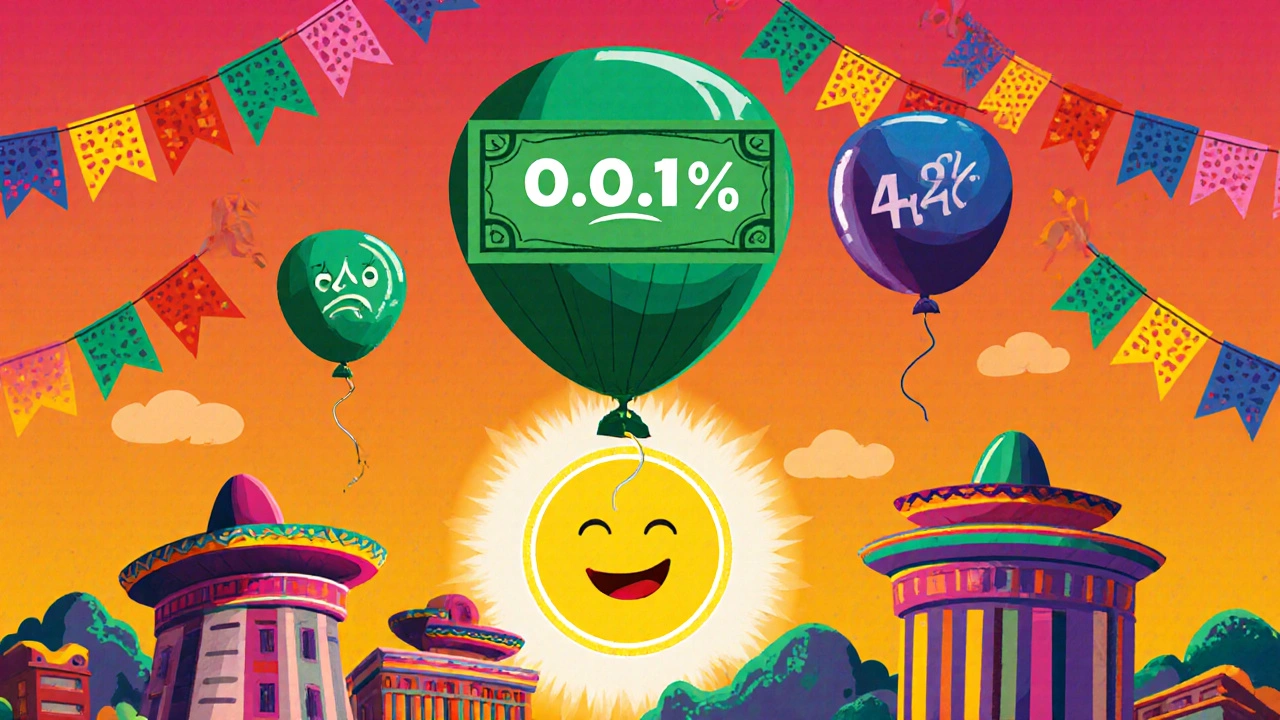

Discover how broker cash sweeps work, why interest rates vary from 0.01% to over 4%, and how to maximize your FDIC coverage and earnings on idle brokerage cash.