Dividend Investing: How to Build Steady Income from Stocks

When you invest in dividend investing, a strategy where you buy stocks that pay regular cash distributions to shareholders. Also known as income investing, it’s not about chasing quick gains—it’s about collecting payments every quarter, year after year, even when markets dip. This isn’t just for retirees. People in their 20s and 30s use it to build passive income without needing to trade daily or time the market.

Dividend investing relies on companies that make real money and choose to share it. These aren’t flashy tech startups—they’re often blue-chip stocks, large, established companies with decades of consistent profits and reliable payouts like Coca-Cola, Johnson & Johnson, or Procter & Gamble. Some investors also turn to REIT dividends, income from real estate investment trusts that own apartments, warehouses, or shopping centers. These pay out at least 90% of their earnings and often offer yields higher than traditional stocks.

What makes dividend investing powerful isn’t just the cash—it’s compounding. Reinvest those dividends, buy more shares, and over time, your income grows on its own. A $10,000 investment in a stock paying 3% annually might earn you $300 the first year. Ten years later, if you reinvested and the company raised its payout, you could be earning $500 or more just from dividends. No trading needed.

But it’s not foolproof. Some companies cut dividends during tough times. Others pay high yields because their stock price has crashed—warning signs, not bargains. You need to look beyond the percentage. Check how long they’ve paid dividends, whether earnings cover the payout, and if the business model is stable. The best dividend investors don’t chase the highest yield—they chase the most reliable ones.

You’ll also find that dividend investing works best when paired with patience. It doesn’t require you to watch the market every hour. You don’t need fancy tools or expensive advice. Just a low-cost brokerage, a few solid stocks, and the discipline to hold through ups and downs. That’s why so many of the posts here focus on practical steps: how to pick dividend stocks without getting tricked, how to avoid tax traps, and how to use dividend income to replace part of your paycheck.

Whether you’re trying to build a side income, prepare for retirement, or just want your money to work while you sleep, dividend investing gives you a clear path. Below, you’ll find real guides on how to start, what to watch out for, and how to make it work for your situation—no fluff, no jargon, just what works.

Special Dividends: What One-Time Payments Mean for Your Portfolio

Special dividends are one-time cash payments from companies to shareholders, often triggered by asset sales or record profits. Learn what they mean for your portfolio, how they're taxed, and whether they signal strength or weakness.

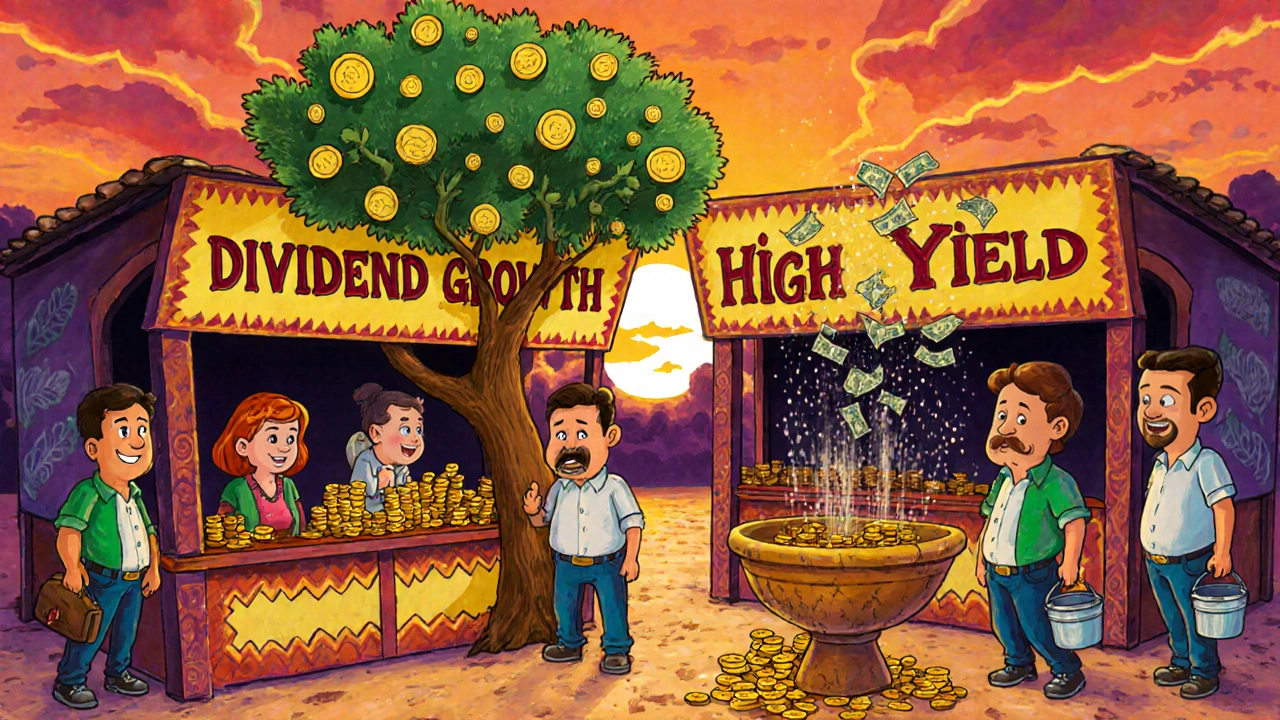

Dividend Growth vs Current Yield: Which Strategy Wins for Long-Term Wealth?

Dividend growth and current yield are two very different paths to income investing. One builds wealth over time. The other gives you cash now - but at a risk. Learn which one suits your goals and why growth often wins long-term.