Dividend Growth: How Consistent Payouts Build Long-Term Wealth

When you invest in a company that grows its dividend growth, the consistent increase in cash payments a company makes to its shareholders over time. It's not just about getting a check—it's about watching that check get bigger every year. This isn’t luck. It’s a sign a business is making more money, has control over its costs, and believes in rewarding people who believe in it long-term. Think of it like a salary raise you earn just by owning a piece of the company.

Dividend growth is closely tied to dividend stocks, shares in companies known for regularly increasing cash payouts to shareholders. These aren’t flashy tech startups. They’re the stable giants—like Coca-Cola, Johnson & Johnson, or Procter & Gamble—that have raised dividends for 20, 30, even 60 years straight. They don’t need to blow up the market to win. They just need to keep making more money than last year. And when they do, they share it. That’s the core of dividend growth investing: patience over hype, stability over speculation.

But here’s the real power: when you reinvest those growing payouts, you buy more shares. And those extra shares earn even more dividends next year. It’s a snowball effect. Over time, that small 2% yield can turn into a 5%, 8%, or even 10% annual return—not from stock price swings, but from the money the company keeps giving you. That’s why dividend reinvestment, the automatic use of dividend payments to purchase additional shares of the same stock is such a quiet game-changer. You’re not chasing trends. You’re building a self-fueling income stream.

Not every company can do this. Many pay dividends, but only a fraction grow them year after year. That’s why investors look beyond just the current dividend yield, the annual dividend payment expressed as a percentage of the stock price. A high yield today might mean the company is struggling. A low yield that’s rising? That’s often the real treasure. You want companies with strong balance sheets, steady sales, and a history of putting shareholder returns first—even when the market gets nervous.

You’ll find posts here that break down exactly how to spot these companies, what to watch for when they pause a raise, how taxes affect your take-home dividend, and how to use them alongside ETFs or REITs to build a portfolio that pays you while it grows. Some posts show you how to start with just $100. Others explain why even in a recession, dividend growers often hold up better than the rest. There’s no magic formula. Just a simple truth: money that grows over time beats money that sits still.

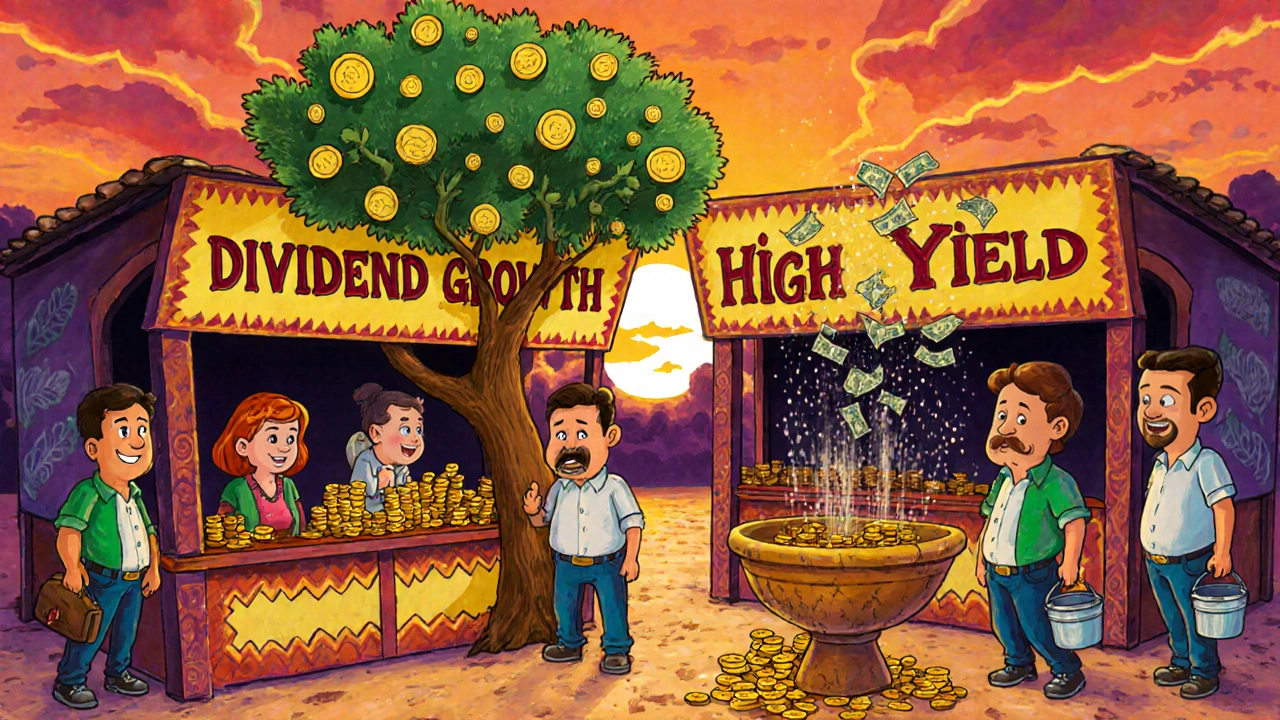

Dividend Growth vs Current Yield: Which Strategy Wins for Long-Term Wealth?

Dividend growth and current yield are two very different paths to income investing. One builds wealth over time. The other gives you cash now - but at a risk. Learn which one suits your goals and why growth often wins long-term.