Current Yield: What It Is and How It Affects Your Bond and Dividend Investments

When you buy a bond or a dividend-paying stock, current yield, the annual income you receive divided by the asset’s current market price. Also known as running yield, it’s not a guess—it’s a real number that shows how much cash you’re getting back right now, not what you might get in the future. It’s the simplest way to compare income from different investments without getting lost in complex formulas or long-term projections.

Think of it like rent for your money. If you buy a bond for $950 that pays $50 in interest each year, your current yield is 5.26%. If another bond pays the same $50 but costs $1,000, its yield is only 5%. The cheaper one gives you more income for the same dollar spent. The same logic applies to stocks. A stock trading at $80 that pays $4 in dividends annually has a 5% current yield. If it drops to $60, that same $4 dividend now gives you a 6.67% yield—your income didn’t change, but your return did. That’s why bond prices, the market value of fixed-income securities that move inversely to interest rates matter so much. When rates rise, bond prices fall, and current yield rises. When rates drop, bond prices climb, and yield shrinks. It’s a direct trade-off.

And it’s not just about bonds. dividend yield, the annual dividend payment divided by the stock’s current price works the same way. Companies like Coca-Cola or Johnson & Johnson don’t change their dividends overnight, but if their stock price swings, your yield changes with it. That’s why investors watch dividend yield like a compass—it tells you if a stock is becoming cheaper or more expensive relative to the income it delivers. But be careful: a high yield can be a trap. If a stock’s price crashes because the company is in trouble, that 8% yield might vanish next quarter. Current yield doesn’t predict safety—it just shows what’s happening today.

What you won’t find in current yield is capital gains, inflation adjustments, or compounding. It’s a snapshot, not a forecast. That’s why it’s used alongside other measures like yield to maturity or total return. But if you’re comparing two similar bonds or two dividend stocks side by side, current yield cuts through the noise. It’s the first number you should check before you click buy.

Below, you’ll find real examples from actual investments—how BNPL fees affect retail profits, how broker cash sweeps earn interest, how special dividends change your income, and why some investors use event-driven rebalancing to capture higher yields during market shifts. These aren’t theory pieces. They’re practical breakdowns of how income works in today’s markets, whether you’re holding $500 or $500,000. No jargon. No fluff. Just what you need to know to make smarter choices with your money right now.

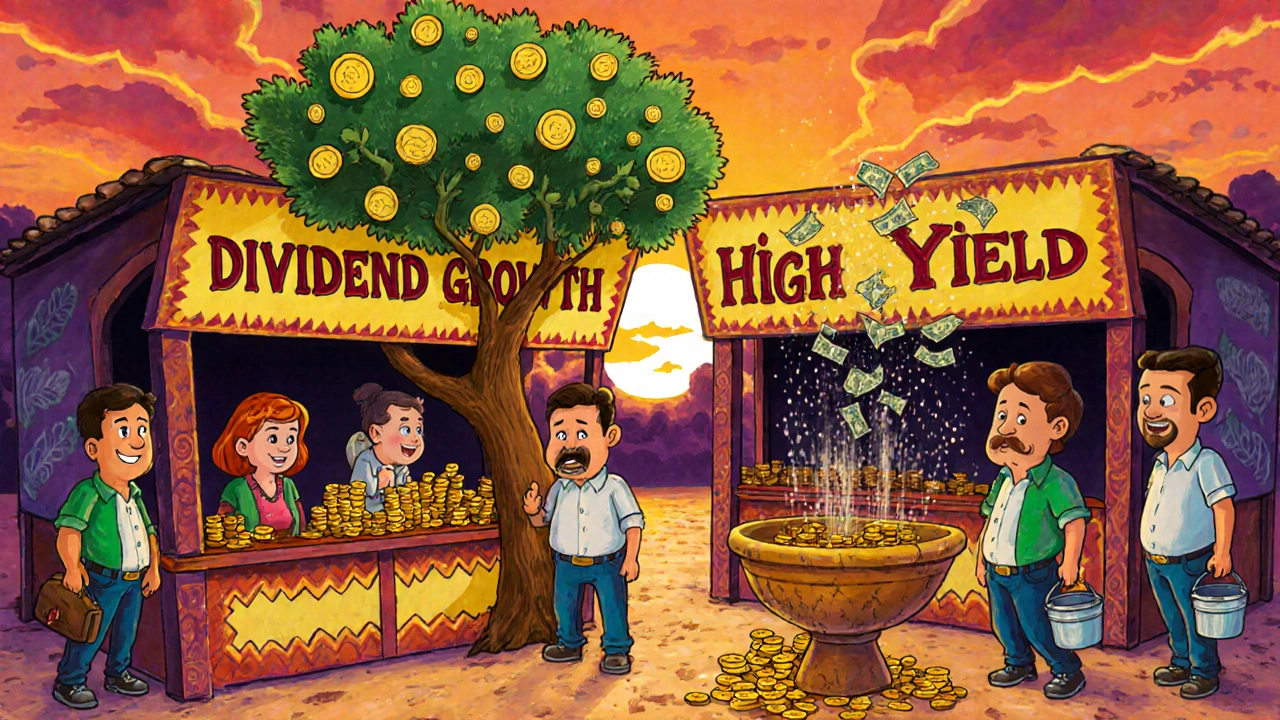

Dividend Growth vs Current Yield: Which Strategy Wins for Long-Term Wealth?

Dividend growth and current yield are two very different paths to income investing. One builds wealth over time. The other gives you cash now - but at a risk. Learn which one suits your goals and why growth often wins long-term.