Cash Sweep Interest Rates: What They Are and How They Boost Your Idle Money

When you keep money in a brokerage or bank account that doesn’t pay interest, you’re losing money—slowly, but surely. A cash sweep interest rate, the rate your financial institution pays on uninvested cash automatically moved to interest-bearing accounts. Also known as sweep interest rate, it’s the hidden engine that turns your spare dollars into passive income without you lifting a finger. Most brokers don’t just leave your cash sitting there. They sweep it daily into money market funds, high-yield savings accounts, or short-term treasuries—and the rate they pay you is the cash sweep interest rate. It’s not glamorous, but in a high-rate environment, it can add hundreds of dollars a year to your portfolio just by doing nothing.

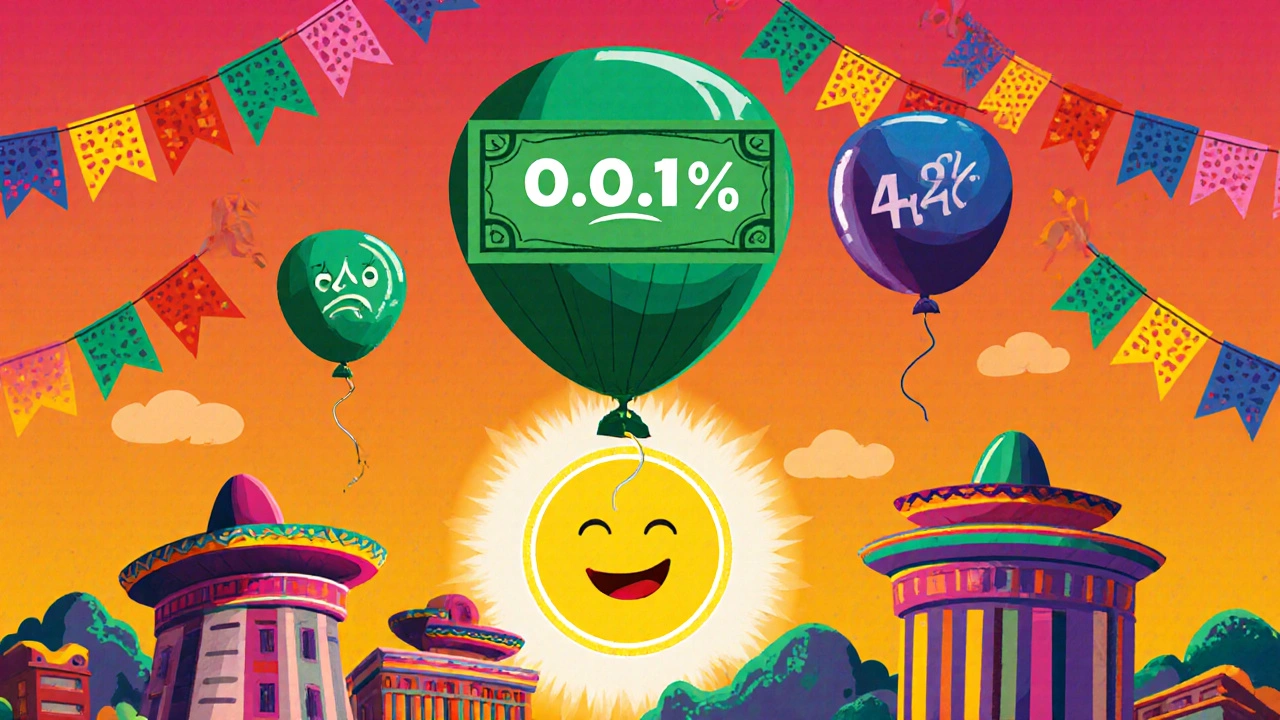

This isn’t just about keeping cash safe. It’s about making it work. If you’re holding $10,000 in uninvested cash and your broker pays 4.5% on sweeps, that’s $450 a year in free interest. Compare that to a traditional checking account paying 0.01%, and you’re talking about a 45,000% difference. The cash sweep account, the automated system that moves unallocated funds into interest-earning vehicles is the bridge between holding cash and earning on it. But not all sweep accounts are equal. Some pay better than others. Some tie to money market funds with low expense ratios. Others link to FDIC-insured bank deposits. And some—especially at discount brokers—offer rates that rival top online savings accounts.

The real trick is knowing where to look. A high-yield savings, a savings account offering significantly higher interest than traditional banks might pay 4.75%, but if your broker sweeps into a money market fund that yields 4.2%, you’re leaving money on the table. You need to check your broker’s disclosures. Look for the actual rate being paid, not the advertised rate for their own products. And remember: rates change. What was 5% last month might be 4.1% today. That’s why monitoring your sweep rate matters as much as picking your stocks.

There’s also a behavioral side. Many investors treat their uninvested cash like spare change—until they realize that cash is the most flexible asset they have. It’s your dry powder for buying dips, covering emergencies, or rebalancing after a market swing. But if that cash isn’t earning, you’re effectively paying a hidden tax. That’s why savvy investors treat their sweep rate like a performance metric. If it’s below 4%, it’s time to ask questions. If it’s below 3%, it’s time to consider moving.

What you’ll find below are real, practical guides on how to compare sweep rates across brokers, how to spot the hidden fees that eat into your returns, and how to use cash sweep accounts as part of a smarter, more active strategy—not just a passive afterthought. Whether you’re new to investing or have been trading for years, your idle cash deserves better than zero. Let’s make sure it’s working for you.

Broker Cash Sweeps: FDIC Programs and Interest Rates Explained

Discover how broker cash sweeps work, why interest rates vary from 0.01% to over 4%, and how to maximize your FDIC coverage and earnings on idle brokerage cash.