Broker Cash Sweeps: How Idle Money Works in Your Investment Account

When you deposit money into a broker cash sweep, a feature that automatically moves uninvested cash from your brokerage account into a higher-yielding account. Also known as cash sweep programs, it’s not magic—it’s basic banking built into your trading platform to make your idle money work harder. Most people think their cash just sits there, earning nothing. But if your broker uses a cash sweep, that cash is being put to work—usually in money market funds, low-risk mutual funds that invest in short-term government and corporate debt or insured deposit accounts, bank accounts protected by FDIC or SIPC insurance. The goal? To earn a little interest while you wait for your next trade.

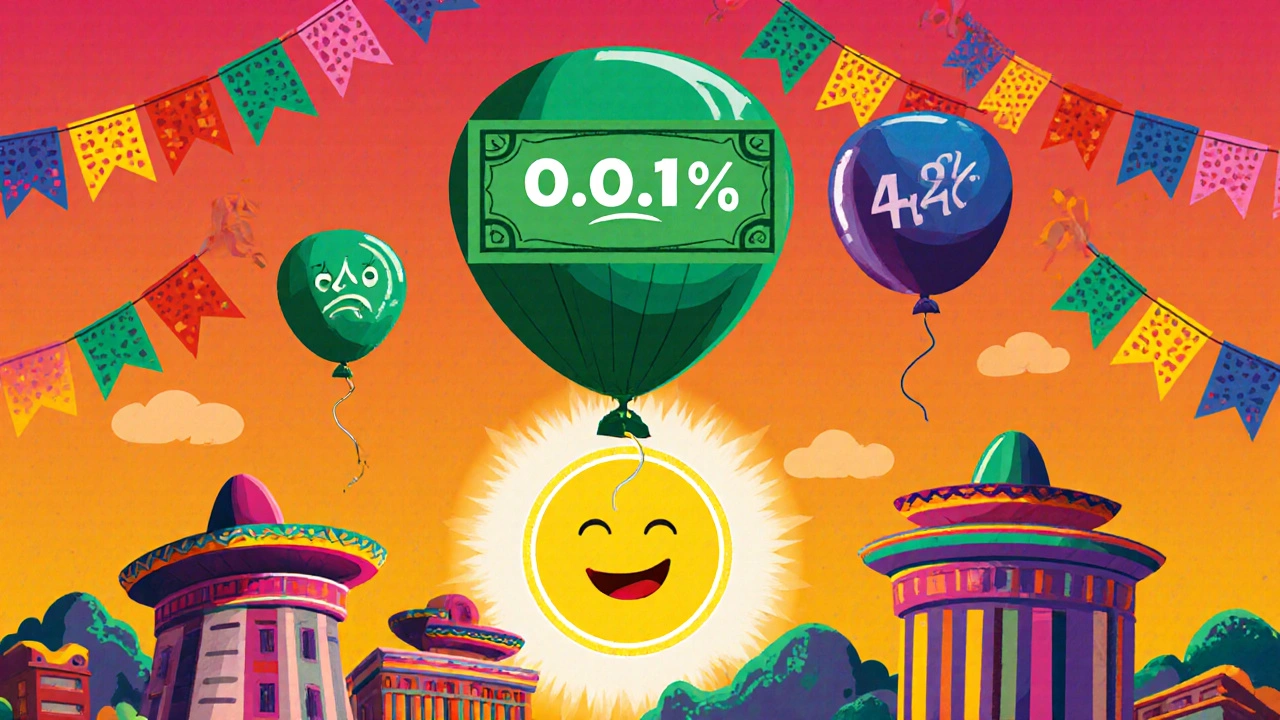

Here’s the catch: not all sweeps are created equal. Some brokers send your cash to high-yield savings accounts that pay 4-5% APY. Others use low-yield money market funds that barely beat inflation. You might not even know which one you’re in—because brokers don’t always make it obvious. If you’ve got $10,000 sitting idle for weeks, a 1% difference in yield means $100 a year. That’s free money you’re leaving on the table. And it’s not just about the rate. Some sweeps tie your cash to the broker’s own funds, which can create hidden conflicts. Others use third-party banks with better rates and stronger protections. Knowing which type you have helps you decide if you should stay or switch.

Broker cash sweeps matter most when markets are volatile. When you’re waiting for a dip to buy stocks, or holding cash after selling a position, that money isn’t just sitting there—it’s earning. That’s why some investors treat cash sweeps like part of their asset allocation. A well-run sweep can act like a low-risk buffer in your portfolio, especially if you’re using dollar-cost averaging or micro-investing apps. It’s not a replacement for bonds or treasuries, but it’s a smarter place for cash than a zero-interest checking account.

You’ll find this feature in almost every major broker—from Fidelity and Schwab to Webull and SoFi. But the details change. Some offer daily compounding. Others limit how much qualifies. A few even let you choose where your cash goes. And if you’re using margin, your sweep might be linked to your borrowing rate. That’s why checking your account’s fine print isn’t just a good idea—it’s essential.

Below, you’ll find real guides on how to spot the best sweeps, avoid hidden fees, compare yields across platforms, and understand how cash management fits into your broader investing strategy. Whether you’re a beginner with $50 to invest or someone managing a six-figure portfolio, your idle cash deserves more attention than it gets.

Broker Cash Sweeps: FDIC Programs and Interest Rates Explained

Discover how broker cash sweeps work, why interest rates vary from 0.01% to over 4%, and how to maximize your FDIC coverage and earnings on idle brokerage cash.