Biometric Security Calculator

Compare Your Security Needs

Answer these questions to see which biometric method is best for your financial transactions

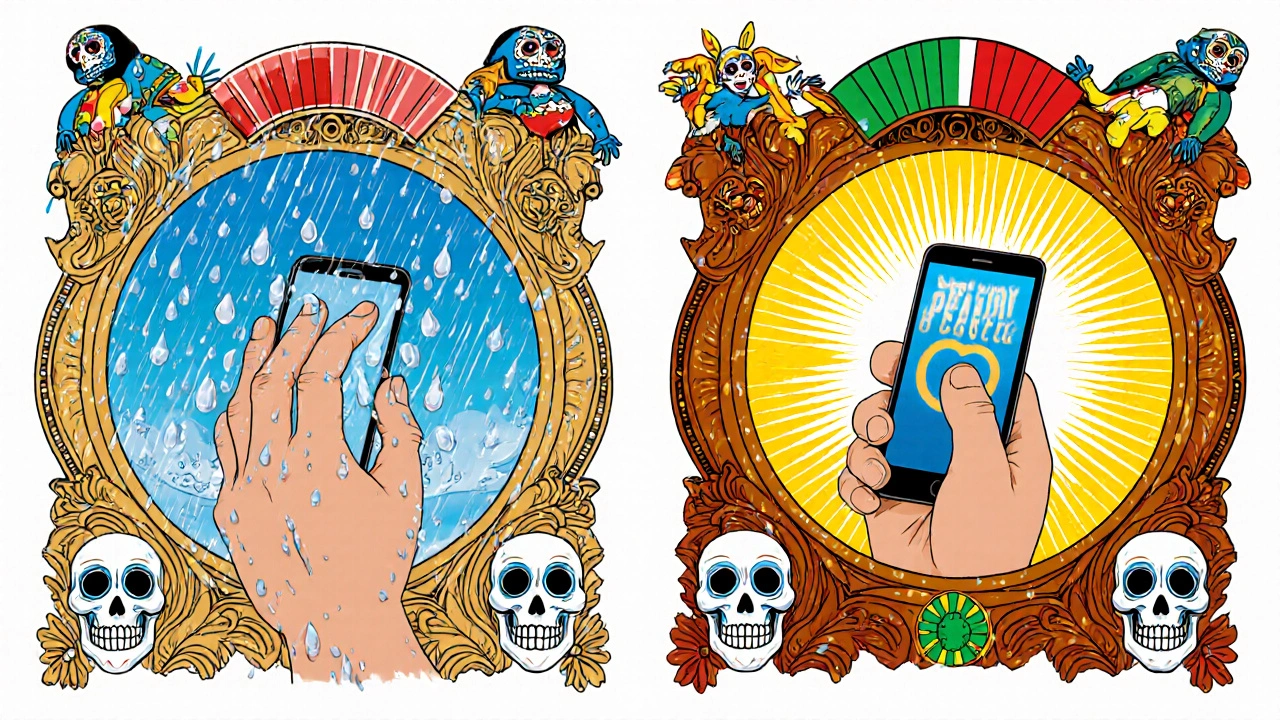

When you unlock your phone to pay for coffee or log into your bank app, you’re not just typing a password-you’re using your body as a key. That’s biometric authentication, and it’s now the backbone of secure fintech transactions. Two technologies lead the pack: fingerprint recognition and face recognition. Both promise convenience, but which one actually keeps your money safer? And why does it matter more than ever in 2025?

How Fingerprint Recognition Works (And When It Fails)

Fingerprint scanners don’t take pictures. They map the unique ridges and valleys on your fingertip using tiny electrical sensors. Most modern phones use capacitive sensors, which measure conductivity differences between skin and air gaps. These sensors are small-about the size of a pencil eraser-and sit under your screen or on the side of your phone. Under ideal conditions, fingerprint systems are incredibly accurate. In controlled labs, false acceptance rates (when someone else gets in) can be as low as 0.001%. That’s one in a hundred thousand chances of being tricked. Apple’s Touch ID, introduced in 2013, set the standard. Even today, banks and financial apps rely on it because it’s predictable and consistent. But real life isn’t a lab. Wet hands? Cracked skin? Dirt on your finger? Suddenly, your phone won’t unlock. MIAxis.net testing shows accuracy drops from 99.9% to as low as 85% when fingers are damp or damaged. That’s a 15% failure rate-enough to make you miss a payment deadline or get locked out of your account mid-transaction. There’s also a hidden vulnerability: fingerprints can be copied. High-resolution photos (1200+ dpi) can be used to create silicone molds that fool older scanners. While newer systems include liveness detection (checking for pulse or sweat), not all devices have it. In 2022, a white paper from Telos Corporation showed how easy it still is to bypass basic fingerprint sensors with a simple mold.How Face Recognition Works (And When It Gets Confused)

Face recognition doesn’t just see your face-it maps it. Apple’s Face ID, launched in 2017, uses over 30,000 invisible infrared dots to create a 3D depth map of your face. It measures the distance between your eyes, the curve of your cheekbones, the shape of your jaw. That’s about 80 nodal points, converted into a mathematical model that only your phone can decode. The big win? No contact needed. You just look at your phone. That’s why adoption exploded after 2020. People didn’t want to touch public keypads or shared devices anymore. In 2023, the TSA processed over 3.2 million facial scans monthly at U.S. airports-with a 96.5% success rate. Retailers and banks followed suit. Accuracy has improved dramatically. In 2018, facial recognition was only 85% accurate. By 2023, it hit 97% thanks to deep learning and better infrared sensors. But it’s not perfect. Direct sunlight? A hat pulled low? A thick beard? A dimly lit room? Accuracy can dip to 70-80%. Recogtech’s 2023 field tests showed failure rates of 40% in bright sunlight and 35% if you’re looking more than 30 degrees off-center. There’s another issue: bias. A 2022 MIT study found facial recognition systems made errors 34.7% more often on darker-skinned women than on lighter-skinned men. That gap has narrowed to 12.3% in 2023 thanks to better training data, but it’s still a concern. If your bank’s system misidentifies you because of your skin tone, that’s not just inconvenient-it’s discriminatory.Accuracy: Fingerprint Still Leads, But the Gap Is Closing

If pure accuracy is your only priority, fingerprint wins. NIST’s 40-year study found fingerprint patterns remain 95% unchanged over decades. Your fingers don’t change with weight gain, aging, or a new hairstyle. That permanence makes them ideal for high-security applications like wire transfers or crypto wallet access. In controlled access tests, fingerprint systems averaged 99.5% accuracy. Facial recognition hit 97.2%. That 2.3% gap might seem small, but in finance, even 0.1% matters. A 0.1% false acceptance rate means one in a thousand unauthorized access attempts could succeed. For a bank handling millions of transactions daily, that’s hundreds of potential breaches a year. But here’s the twist: facial recognition is catching up fast. Incode’s 2023 report shows facial recognition accuracy jumped from 85% to 97% in just five years. With multimodal systems-combining face and fingerprint or face and iris-accuracy now hits 99.9%. Samsung’s Galaxy S23 Ultra already does this. Apple is rumored to add under-display fingerprint sensors to its 2024 iPhones, creating a dual-biometric system.

Speed, Convenience, and User Experience

Let’s talk about daily life. How long does it take to unlock your phone? Fingerprint systems need you to press your finger down, align it just right, and wait. Average time: 0.2 to 0.5 seconds. But if you’re fumbling with your phone in your bag, or your finger is sweaty? That turns into 1.8 seconds of frustration. Face recognition? You glance at your phone. It unlocks in 0.3 to 0.7 seconds. No touching. No positioning. You can unlock it while walking, holding groceries, or wearing gloves. SGA Security’s 2023 usability study found 87% of users preferred face recognition for daily use. Only 63% said the same for fingerprint. In high-traffic environments-like a bank lobby with 50 people waiting to deposit cash-facial recognition processes users faster. Fingerprint scanners can only handle one person at a time. Face recognition systems can scan multiple people in a queue, making them ideal for branch lobbies or ATMs.Cost and Deployment: What Businesses Pay

For businesses, cost matters. A basic fingerprint sensor for an access control system runs $50-$150. Facial recognition systems? $200-$500. That’s a 100-250% premium. Why? Because they need infrared cameras, depth sensors, and better processing power. Installation time is longer too. Fingerprint systems take 2-3 hours to set up. Facial recognition needs 4-6 hours because cameras must be positioned perfectly, lighting tested, and angles calibrated. But once it’s done, maintenance is easier. Fingerprint sensors get gunked up with oils and dirt-requiring weekly cleaning. Facial recognition systems need quarterly lighting recalibration and almost no daily upkeep.Regulations and Privacy: What the Law Says

In the EU, facial recognition is treated as sensitive personal data under GDPR. You must give explicit consent before your face is scanned. Fingerprint data is also protected, but under slightly less strict rules. In the U.S., Illinois’ Biometric Information Privacy Act (BIPA) fines companies $5,000 per violation if they collect biometrics without consent. Similar laws exist in Texas, Washington, and a few other states. That means if your fintech app uses face recognition without a clear opt-in, you could be breaking the law-even if you think it’s “just for convenience.”

Which One Should You Use? Real-World Scenarios

- High-security transactions (wire transfers, crypto wallets): Use fingerprint. It’s more accurate, harder to spoof, and trusted by banks.

- Everyday mobile payments (Apple Pay, Google Pay): Face recognition wins. Faster, cleaner, and you don’t have to touch your phone while holding coffee.

- Bank branches or ATMs: Facial recognition scales better. One camera can verify 10 people in the time it takes a fingerprint scanner to do one.

- Employees clocking in at work: Face recognition avoids hygiene issues and speeds up rush hours.

- Users with damaged fingers or disabilities: Face recognition is more inclusive-if the system is well-designed.

The Future: Multimodal Is the Winner

The real answer isn’t fingerprint or face. It’s both. Gartner reports that 63% of new enterprise biometric systems now combine two or more methods. A bank might use face recognition to let you into the app, then ask for a fingerprint to approve a large transfer. That’s called multimodal authentication. These systems reduce false acceptance rates to below 0.0001%-one in a million. That’s better than any single method. Apple’s rumored 2024 iPhone update, combining under-display fingerprint sensors with Face ID, could make this the new standard for consumer devices. By 2026, facial recognition will likely be the most common biometric method used-but fingerprint will still be the backup for the highest-risk actions. Neither is going away. They’re becoming partners.Final Thought: It’s Not About the Tech. It’s About Trust.

Biometric authentication isn’t magic. It’s math, sensors, and algorithms. But what makes it powerful is how it feels: effortless, personal, secure. Fingerprint gives you confidence because it’s proven. Face recognition gives you freedom because it’s fast. The best fintech apps don’t choose one-they give you both. And that’s the future: not just better security, but better experiences.Is fingerprint recognition more secure than face recognition?

Under ideal conditions, yes. Fingerprint recognition has a lower false acceptance rate (as low as 0.001%) compared to facial recognition (typically 0.1%-1%). However, facial recognition systems with advanced liveness detection (like Apple’s Face ID) have reduced spoofing risks to 1 in 1,000,000. For most users, both are secure-but fingerprint is still the gold standard for high-value financial transactions.

Can someone steal my face to unlock my phone?

It’s possible, but very difficult with modern systems. Basic facial recognition can be fooled by a high-quality photo. But systems like Face ID use infrared dot mapping and 3D depth sensing, making it nearly impossible to trick with a photo or mask. Apple claims its system has a 1 in 1,000,000 chance of being fooled. Older or low-cost facial recognition apps may still be vulnerable.

Why does my face recognition fail in sunlight?

Most facial recognition systems rely on infrared light to map your face. Bright sunlight can overwhelm the infrared sensors, making it hard for the camera to detect your facial features. Systems with better infrared filters and adaptive lighting perform better, but direct sun exposure still causes failures in about 40% of cases, according to Recogtech’s 2023 testing.

Do fingerprint sensors work with wet fingers?

Not always. Wet, sweaty, or dirty fingers reduce accuracy by up to 15%. Older capacitive sensors struggle with moisture because water disrupts the electrical signal. Newer ultrasonic sensors (like those in Samsung’s Galaxy S23) can scan through water and screen protectors, achieving 98.7% accuracy even with wet fingers.

Is facial recognition biased against people with darker skin?

Early facial recognition systems had significant bias, with error rates up to 34.7% higher for darker-skinned women. Thanks to improved training data and regulations, newer systems have reduced this gap to about 12.3%. However, bias hasn’t been eliminated. Always check if your fintech app uses updated, inclusive models-and consider using fingerprint as a fallback if face recognition fails repeatedly.

Which is better for banking apps: fingerprint or face recognition?

For everyday logins, face recognition is faster and more convenient. For large transfers or sensitive actions, fingerprint is more reliable and trusted by financial institutions. The best apps use both: face to unlock, fingerprint to authorize. If your bank only offers one, choose fingerprint for maximum security.

RAHUL KUSHWAHA

November 16, 2025 AT 18:41Been using fingerprint on my phone for years, but lately my hands get so dry in Delhi winter that it fails like 3/5 times. Face unlock works even when I’m wearing gloves-just don’t go outside during monsoon or it ghosts me. 😅

Julia Czinna

November 18, 2025 AT 05:52It’s funny how we treat biometrics like they’re infallible, when really they’re just math with a human face slapped on top. Fingerprint’s more reliable for high-stakes stuff, no doubt-but the bias in facial recognition isn’t just a bug, it’s a feature of outdated datasets. If your bank’s system still struggles with darker skin tones in 2025, they’re not just lazy, they’re negligent. Glad to see multimodal systems gaining traction, though. That’s the only real win here.

Laura W

November 19, 2025 AT 03:39Okay but let’s be real-face unlock is the whole reason I don’t hate my phone anymore. I’m holding a latte, one kid on my hip, the other screaming for cereal, and I just glance at my phone and BOOM-logged in. Fingerprint? Nah. I’d rather stab myself in the eye than fumble with a sweaty thumb while my coffee cools. And yeah, sunlight messes with it, but so does my toddler smearing peanut butter on the screen. We adapt. Plus, multimodal is the future. Apple’s gonna drop that under-display fingerprint + Face ID combo next year and we’re all gonna lose our minds. This isn’t security tech anymore-it’s life tech. 🚀

Graeme C

November 20, 2025 AT 20:37Let’s cut through the marketing fluff. Fingerprint recognition has been the gold standard for a reason: it’s predictable, it’s physical, and it’s damn hard to spoof without a 3D-printed mold and a lab. Face recognition? It’s a beautiful illusion. One bright sunbeam, one poorly calibrated IR sensor, and suddenly your bank thinks your cousin from Nigeria is you. And don’t get me started on the bias-this isn’t ‘algorithmic error,’ it’s systemic negligence disguised as innovation. If your fintech app can’t handle a 12% differential in recognition accuracy based on skin tone, it shouldn’t be allowed to process a single transaction. The future isn’t ‘both.’ The future is ‘better.’ And right now, fingerprint still delivers that. Face recognition is a flashy distraction with real-world consequences.